Projected to exceed $360 billion by 2034, the global weight loss industry is experiencing significant growth, driven by key trends such as personalization, prevention, and digital health. With easier access to information and technology, consumers are making more informed choices about their weight loss strategies, preferring evidence-based and scientifically backed solutions.

The accelerating rise in obesity, paired with an increasing demand for healthier lifestyles, is reshaping the weight loss industry. Businesses are capitalizing on the shift toward digital health platforms, mobile apps, and personalized nutrition plans that integrate genetics, lifestyle, and health data—redefining consumer expectations and setting new standards for innovation and engagement.

Introduction

Today’s businesses are recognizing weight management as a critical part of overall health and wellness, rather than just about appearance. This shift has created opportunities for companies to deliver solutions that support consumers’ focus on sustainable lifestyle changes, particularly in diet and physical activity, driving long-term engagement and results Additionally, the rapid growth of GLP-1 receptor agonists is revolutionizing medical weight loss, opening new avenues for pharmaceutical innovation and expanding market opportunities.

Leading strategies include tailored fitness routines and personalized nutritional plans focused on healthy eating choices. This comprehensive approach to weight management integrates mindful eating with an active lifestyle, fostering sustainable and individualized health outcomes.

This article unpacks the key drivers behind the weight loss boom, the shifts in consumer behavior, and the innovations reshaping the space.

What Fuels the Growth and Transformation of the Weight Management Market

By 2035, obesity is projected to affect 51% of the global population of over 4 billion people- according to the World Obesity Federation’s 2023 report. This alarming trend includes childhood obesity rates, with over 350 million children expected to be diagnosed as obese within the next 12 years. Additionally, the economic burden of obesity-related health conditions is anticipated to surpass $4 trillion annually by 2035, representing approximately 3% of the global GDP.

The escalating global obesity crisis is largely driven by lifestyle shifts, including increased sedentary behavior, and consumption of high-calorie fast foods, alcohol, and tobacco. The rising obesity rates elevate the risk of chronic health conditions such as cardiovascular diseases, diabetes, and hypertension. As obesity rates continue to rise, the demand for medical interventions and weight management solutions is increasing.

This dynamic is also raising awareness about the importance of addressing obesity through preventive and corrective measures, fueling the growth of the weight loss industry.

The weight loss industry plays a critical role in addressing these challenges by delivering personalized, structured solutions such as tailored diet plans, targeted exercise programs, and guided physical activity strategies. By leveraging customization, these offerings not only support individuals in achieving healthier body weights but also help mitigate the long-term health and economic burdens associated with obesity.

Understanding the Value of the Weight Loss Industry

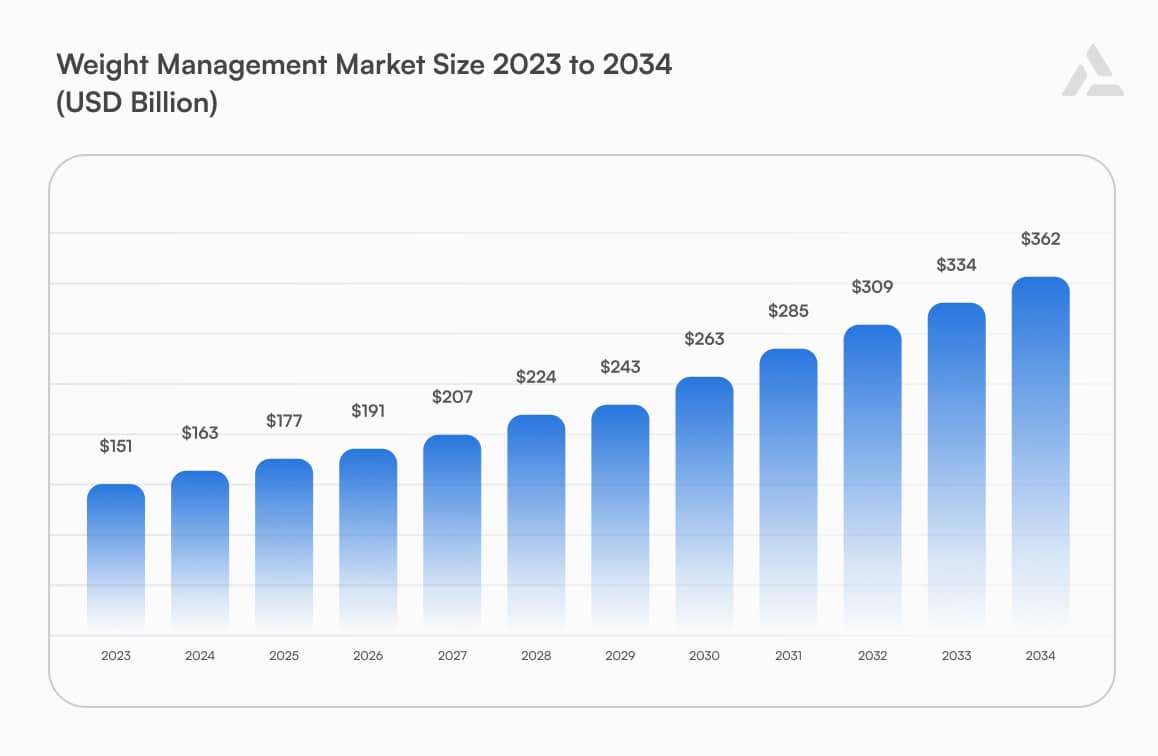

The global weight loss market is a dynamic and rapidly expanding industry that is projected to grow significantly over the next decade. According to the latest weight loss industry statistics, the market was valued at approximately $163.13 billion in 2024 and is expected to exceed $362.1 billion by 2034, growing at a compound annual growth rate (CAGR) of nearly 8.3%.

Key drivers of this market include:

- Pharmaceutical innovations: GLP-1 receptor agonists are emerging as a major driver in the weight loss industry, offering highly effective pharmaceutical solutions for weight management. These groundbreaking medications are not only transforming patient outcomes but also significantly expanding the market for medical weight loss treatments.

- Diverse product categories: meal replacements, dietary supplements, and weight-loss beverages are dominating the market. Functional beverages alone account for a substantial share, appealing to busy consumers with ready-to-drink options.

- Innovative weight management services: the rise of online weight-loss programs, offering convenience and personalized plans, has captured the largest market share in services.

- Technological advancements, including the rise of artificial intelligence, are transforming how individuals approach weight management. From fitness apps powered by AI-driven insights to connected devices like wearable fitness trackers, technology is making personalized health guidance more accessible and effective than ever before.

Trends in Global Weight Loss Industry Revenue

Regional dynamics also play a significant role. North America leads the global market, driven by high obesity rates and extensive healthcare infrastructure.

The U.S. weight loss market is valued at approximately $90 billion as of 2023 and is expanding at a CAGR of 8.2%.

Key drivers include:

- A higher prevalence of obesity (around 40% of adults as per CDC data) and extreme obesity drive demand for both medical and non-medical weight loss solutions.

- Robust adoption of medical interventions, supported by advanced healthcare infrastructure and insurance coverage.

- Declining interest in traditional weight loss programs, with a shift toward pharmacological and digital solutions.

The Asia-Pacific region, driven by rising disposable incomes and increasing health awareness, is positioned for the fastest growth in the weight loss industry. In 2024, the weight loss management market reached an estimated value of $24.23 billion, accounting for roughly 23% of global industry revenues. This underscores its significant market share and strong competitive position.

Meanwhile, Europe sees a steady demand for personalized, sustainable weight management options, having a market size of approximately $80.92 billion in 2023.

Yet, the economic aspects of the weight loss industry also reflect each region’s cultural attitudes regarding dietary habits, perceptions of body image, and approaches to weight management.

Cultural Differences in Weight Loss and Weight Management: US, Europe, and Asia

Weight loss and weight management approaches vary significantly across cultures, shaped by societal values, dietary traditions, and health and body image perceptions. These cultural differences influence consumer behavior and market strategies for businesses in the health and wellness industry.

In the United States, weight loss services are shaped by a strong focus on personalization, individualism, and quick results. Consumers increasingly expect tailored solutions, driving demand for customized meal replacement products, fitness programs, and subscription-based weight loss services that fit seamlessly into their lifestyles. Marketing strategies often leverage aspirational messaging, highlighting transformation, self-improvement, and the unique journey of each individual—an approach that resonates deeply and fosters long-term customer engagement.

Europe, on the other hand, tends to adopt a more holistic and moderate approach. The emphasis lies on maintaining a balanced lifestyle rather than rapid weight loss. Cultural norms in many European countries prioritize fresh, whole foods over heavily processed alternatives alongside smaller portion sizes as part of traditional diets. Weight management often intertwines with sustainable practices, with a growing trend toward eco-conscious and plant-based products.

In Asia, weight management is deeply influenced by traditional medicine and cultural perceptions of beauty. For instance, concepts like Ayurveda in India or Traditional Chinese Medicine emphasize balance and harmony, impacting weight loss strategies. Many Asian consumers favor herbal supplements and natural remedies.

Understanding these regional nuances is crucial for businesses looking to position their products effectively.

Here’s an overview of the global trends for each segment of the weight loss industry.

The Global Market for Technology-Driven Weight Loss Solutions

Technology is rapidly transforming the weight loss industry, offering innovative, data-driven solutions for managing health. Valued at an estimated $19.34 billion in 2024, the market for technology-driven weight loss solutions is projected to grow at a compound annual growth rate (CAGR) of over 8.32% through 2034. This expansion is driven by advancements in wearable devices, AI-powered apps, and personalized platforms designed to meet the needs of modern lifestyles.

The fitness industry is projected to be worth $257 billion in 2025, climbing to $434.74 billion by 2028. This significant growth is fueled by increasing consumer interest in health and wellness, alongside the adoption of advanced fitness technologies that seamlessly integrate into modern lifestyles.

Key trends in technology-driven weight loss solutions include:

- Wearable devices and IoT integration: fitness trackers, smartwatches, and IoT-enabled devices are becoming indispensable tools in weight management. Devices like Fitbit and Apple Watch provide real-time metrics such as calorie expenditure, heart rate, and activity levels, helping users stay accountable.

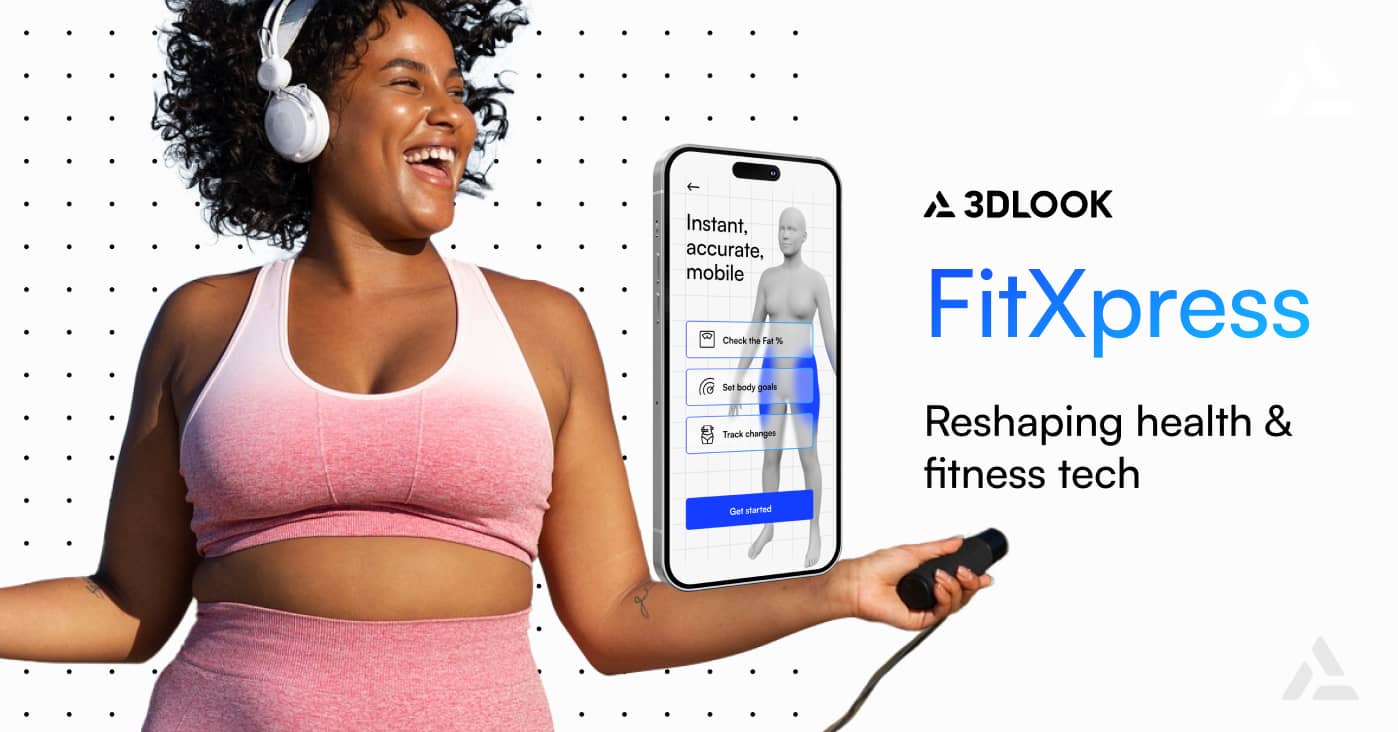

- AI-driven personalized apps: FitXpress, Whoop, and MyFitnessPal leverage artificial intelligence data to provide personalized insights and recommendations. Whoop focuses on fitness and recovery metrics, and MyFitnessPal tracks nutrition and exercise.

FitXpress, for instance, uses cutting-edge body scanning technology, delivering precise body measurements and personalized fitness analytics. It provides in-depth assessments of body composition, including key metrics such as metabolic rate and BMI, enabling effective obesity evaluation and management. These insights empower users to track progress and optimize their fitness routines, making the technology an essential tool for businesses focused on delivering tailored health solutions for weight loss.

- Telehealth and virtual coaching: digital health solutions are enabling remote consultations with nutritionists, trainers, and mental health professionals. This shift caters to the demand for convenience while expanding access to expert guidance.

- Gamification and virtual reality: gamified elements and VR workouts are increasing engagement, particularly among younger demographics. These solutions make weight management more interactive and enjoyable.

- Data-driven insights and analytics: tech solutions now offer deeper analytics, enabling users to monitor long-term progress. Advanced tools provide insights into factors such as sleep patterns, stress levels, and metabolic rates, offering a holistic view of health.

For businesses, technology-driven weight management presents significant opportunities to innovate through strategic partnerships, advanced data integration, and the creation of personalized solutions tailored to consumer needs. Success in this space hinges on delivering seamless user experiences and leveraging cutting-edge technology to meet the growing demand for personalized weight management solutions.

The Weight Loss Supplements Industry

The global weight loss supplements market is a cornerstone of the broader weight management industry, valued at approximately $24.63 billion in 2023, with projections of USD 27.89 billion in 2024. The market is also expected to grow at a robust CAGR of 7-8% through 2032, with Herbalife Nutrition, Amway Corporation, and GNC as top players in the industry.

This growth reflects the rising consumer demand for effective, convenient, and accessible solutions to support weight management and promote healthier lifestyles. For businesses, this expanding market offers opportunities to innovate with scientifically backed products and targeted marketing strategies that address evolving consumer needs.

Key market drivers and trends:

- Shift towards natural and herbal products: consumer preferences are leaning heavily towards supplements made from plant-based or natural ingredients, perceived as safer alternatives to synthetic options. Brands are responding by incorporating superfoods, herbal extracts, and organic ingredients into their formulations.

- Expansion of e-commerce: Online platforms are transforming supplement distribution by integrating personalized algorithms and adopting direct-to-consumer models. These advancements allow brands to enhance customer engagement, improve accessibility, and streamline the purchasing experience.

- Functional supplements with multifaceted benefits: weight loss supplements are increasingly being marketed for dual purposes, like improving gut health, enhancing immunity, or managing energy levels. This trend aligns with the growing consumer focus on holistic health solutions.

- Targeted demographics: innovative marketing strategies now cater to specific groups, such as women-focused products or age-specific formulations. The industry’s ability to adapt to diverse customer needs drives growth across segments.

- Regulatory scrutiny and quality assurance: with increasing global scrutiny over supplement safety and efficacy, reputable brands are investing in clinical trials, transparent labeling, and third-party certifications to build consumer trust.

For businesses, staying competitive means embracing innovation in product development, leveraging digital platforms for marketing, and aligning with regulatory standards to ensure quality.

The Global Weight Management Services Market

The weight management services industry is a critical segment of the global weight loss market, encompassing fitness centers, consulting services, surgical and weight loss clinics, and online programs.

Valued at $19.34 billion in 2024, this market is expected to grow significantly, driven by increasing obesity rates, a focus on preventive healthcare, and technological advancements.

Key trends shaping the industry:

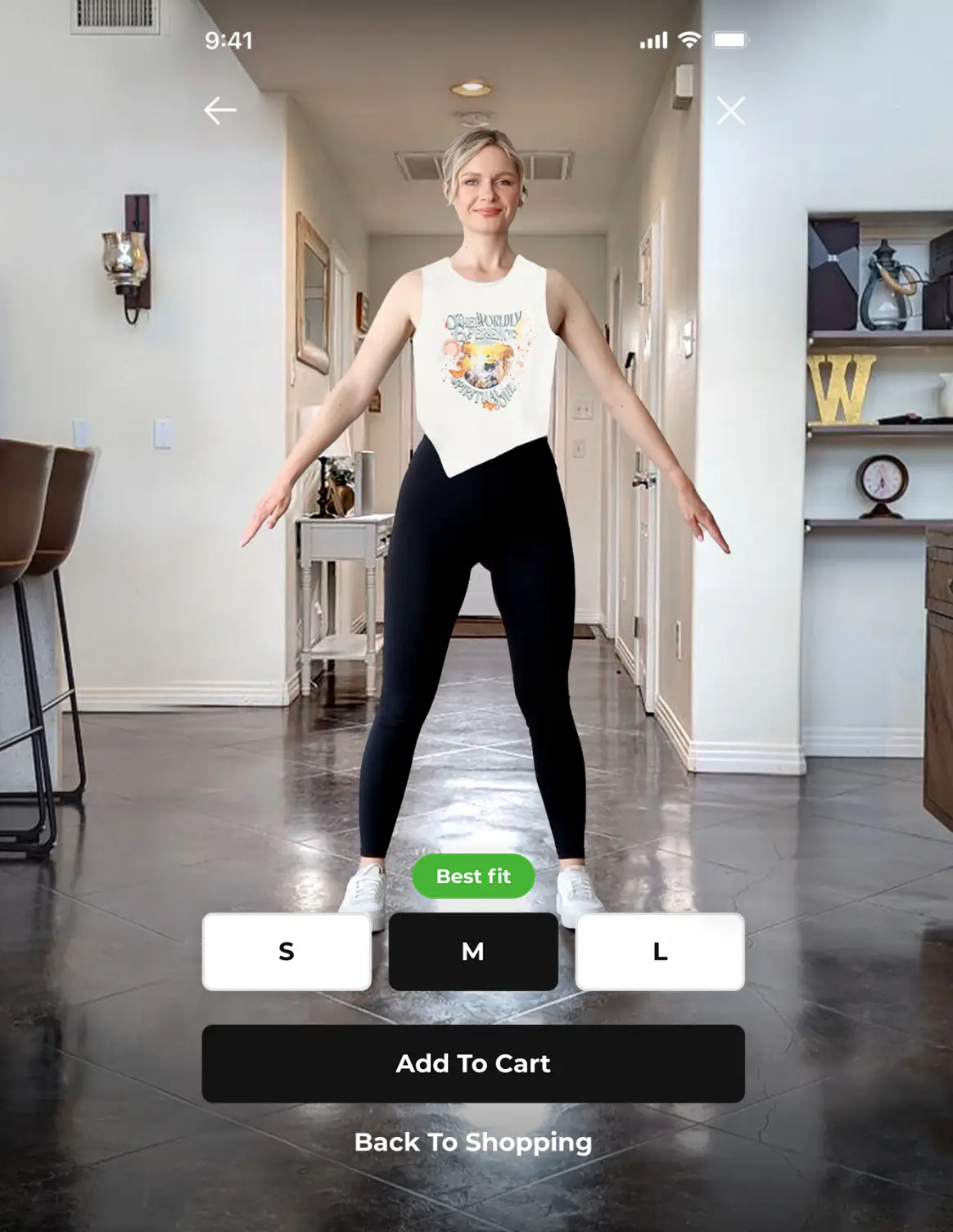

- Digital transformation: Online weight management programs now dominate the market, offering unmatched flexibility and personalization. Many platforms leverage AI-driven tools, such as dynamic meal planning, real-time fitness tracking, and predictive analytics, to create highly tailored experiences. By analyzing user behavior and preferences, these programs ensure that weight management solutions are more accessible, effective, and engaging than ever before.

For instance, FitXpress by 3DLOOK offers a robust and adaptable solution tailored for fitness, telehealth, and weight management industries to harness the power of AI body data. Designed for seamless integration, it empowers businesses to align cutting-edge 3D body scanning technology with their unique branding and user experience to deliver personalized body composition data and body transformation experiences.

FitXpress offers iOS and Android SDKs with versatile API integrations, enabling seamless integration into existing systems. White-label customization ensures businesses can align the platform with their brand, delivering a cohesive and personalized user experience.

- Rise of hybrid service models: traditional fitness centers and consulting services are integrating digital components, such as virtual coaching and telehealth consultations. This hybrid approach appeals to time-constrained customers while maintaining the value of in-person interaction.

- Holistic wellness offerings: weight management services are increasingly incorporating mental health support, nutritional education, and fitness plans to address the root causes of weight-related issues comprehensively.

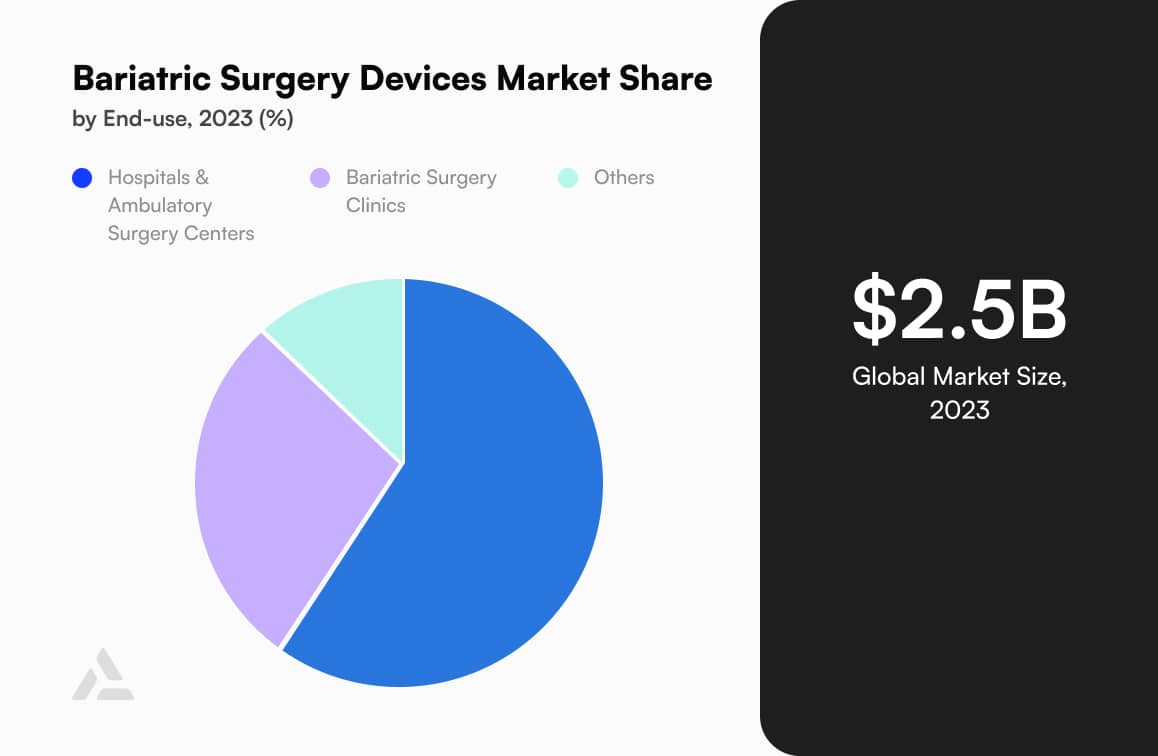

- Bariatric and surgical growth: the demand for bariatric surgery continues to rise, driven by the growing prevalence of severe obesity. Advances in minimally invasive techniques and partnerships between healthcare providers and surgical clinics are further fueling this segment.

- Customized solutions for target demographics: services tailored to specific groups, such as women, children, or seniors, are gaining traction. This targeted approach allows businesses to cater to diverse customer needs more effectively.

Adapting to these trends can help businesses meet the evolving demands of a health-conscious consumer base.

GLP-1 and Other Weight Loss Medication

For decades, weight loss strategies have primarily centered around calorie reduction and increased physical activity, emphasizing personal discipline and willpower. While these traditional approaches remain foundational, advancements in medical research are revolutionizing the field. Innovative, biology-focused medications like Semaglutide and Tirzepatide are gaining prominence, addressing the physiological root causes of weight gain and delivering remarkable outcomes for patients.

These breakthroughs are reshaping weight management paradigms. Personalized plans incorporating injectable therapies and medically supervised programs are becoming increasingly common. Governments worldwide are responding to the obesity epidemic by improving access to prescription weight loss treatments, aiming to alleviate its widespread health and economic burden.

The weight loss drug market is estimated at approximately USD 26.3 billion in 2024. This market is projected to grow substantially, reaching USD 108.9 billion by 2031, which reflects a compound annual growth rate (CAGR) of 19.7% from 2024 to 2031.

The popularity of GLP-1 medications like Ozempic and Wegovy has skyrocketed, leading to high demand and, at times, shortages.

Consumers are increasingly pairing GLP-1 medications with body contouring treatments to address localized fat deposits that cannot be achieved by weight loss drugs alone.

The Paradigm Shift in Healthcare

The accessibility of GLP-1 medications for weight loss, such as semaglutide and liraglutide, is significantly hindered by high costs and limited insurance coverage. While these medications have shown efficacy in achieving substantial weight loss, their affordability remains a challenge, especially for patients without diabetes who often face restricted insurance reimbursement.

This has sparked critical discussions within the healthcare industry regarding the need for broader coverage policies to ensure equitable access, particularly as obesity is increasingly recognized as a chronic health condition requiring medical intervention.

Aggressive marketing of GLP-1 medications has further complicated the landscape, raising ethical concerns about promoting these treatments to populations who may not need them or may face heightened risks of adverse effects. For insurers and healthcare providers, balancing the benefits of these drugs against their costs and potential misuse is crucial.

Addressing these issues will require collaboration across stakeholders to establish policies that prioritize patient safety and affordability while supporting innovation in obesity management.

Final Thoughts

The weight loss industry is poised for transformative growth, driven by technological advancements, evolving consumer preferences, and the global obesity epidemic.

While the U.S. remains a leader in innovation and market size, other regions, particularly in Asia-Pacific, are rapidly advancing, driven by urbanization and rising healthcare awareness. As personalization, telehealth integration, and sustainability continue to evolve, these trends will redefine the weight management industry, unlocking transformative opportunities for businesses to innovate and deliver greater value to consumers.

With the help of science-backed, inclusive, and technology-driven approaches, the weight loss industry will continue to address global health challenges effectively, fostering a healthier and more informed society.