The GLP-1 market’s expansion is reshaping the landscape of multiple industries. The ripple effects of GLP-1 drugs’ success in weight management are felt in the telemedicine, food industry, and even fashion resale market.

GLP-1 drugs’ efficacy in promoting weight loss has led to a significant surge in popularity, with recent reports indicating that the global GLP-1 market is valued at a staggering $49.3 billion. Companies are forced to adapt to the shifting landscape, integrating medical advancements into their business models to meet consumer demand.

Introduction

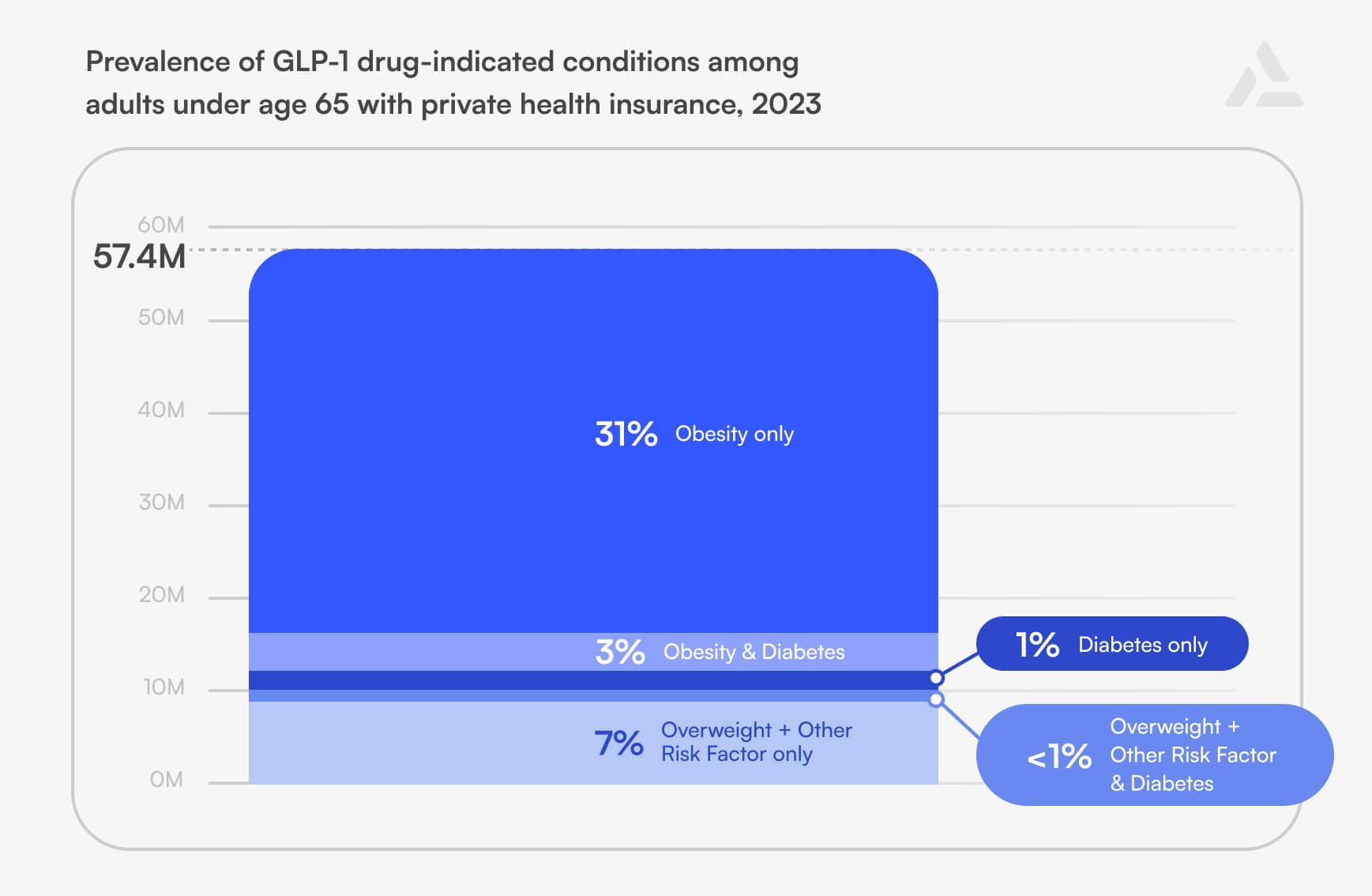

The global GLP-1 drug market is rapidly expanding, with significant implications across various industries. As more consumers adopt these weight loss medications, businesses in sectors such as telehealth, fitness, apparel, and healthcare are experiencing changes that cannot be ignored. The rise of GLP-1 drugs like Ozempic and Wegovy presents both opportunities and challenges, with businesses needing to adapt to shifting consumer habits or risk falling behind.

Find out more below about the impact of GLP-1 drugs across various sectors, from telehealth to fitness, apparel, and insurance, outlining how businesses can capitalize on this transformative trend.

What Exactly Is GLP-1 and How It Became A Mainstream Solution for Weight Loss

First discovered in the 1980s, GLP-1 quickly proved more effective at boosting insulin secretion than other medications. While it was initially created to help manage type 2 diabetes, researchers soon realized it also had a powerful impact on weight loss. This discovery led to the approval of GLP-1 drugs for treating obesity, offering a fresh option for people struggling to manage their weight.

Fast forward to today, and GLP-1 receptor agonists (GLP-1RAs) are now a key tool for treating both type 2 diabetes and obesity. These meds provide a flexible and effective way to handle these conditions.

Key Players in the GLP-1 Drugs Market

Novo Nordisk has been at the forefront of GLP-1 drug development. One of their standout drugs is semaglutide, sold under the names Ozempic for diabetes and Wegovy for weight loss. Thanks to their cutting-edge technology, they’ve been able to extend the effectiveness of these drugs. The company is also researching dual-action drugs targeting GLP-1 and other pathways to improve results. For example, a recent phase 1 trial showed promising results, with participants losing up to 13.1% weight loss over 12 weeks.

On top of that, Novo Nordisk continues to expand its pipeline of GLP-1 therapies, focusing on boosting effectiveness and minimizing side effects. They’re also exploring hormone combinations to ramp up weight loss and other metabolic benefits.

Eli Lilly has also made strides in this field with their drug tirzepatide, a dual GIP and GLP-1 receptor agonist. Approved for long-term weight management in 2023 under the name Zepbound, it’s been shown to significantly lower A1C levels and body weight in clinical trials. Additionally, Eli Lilly’s latest injectable drug, Retatrutide, is showing major promise. Recent data from 2024 revealed that participants lost an average of 15.6% of their body weight after 48 weeks.

GLP-1 Market Size and Growth Projections

The global GLP-1 receptor agonist manufacturers market was valued at approximately $44.5 billion in 2023 and estimated at $49.3 billion in 2024.

Moreover, the GLP-1 drug market is projected to grow at a compound annual growth rate (CAGR) of 10.3% from 2024 to 2031. This growth is driven by the rising rates of obesity and diabetes, along with the high effectiveness of GLP-1 medications.

J.P. Morgan has doubled its market forecast for GLP-1 drugs, estimating that the market will reach $100 billion by 2030. This revised projection stems from the strong demand for obesity treatments and the potential of GLP-1 drugs to manage various comorbidities associated with obesity.

The market forecast for GLP-1 drugs highlights an opportunity for businesses to align with these trends, offering solutions that complement or benefit from the drug’s rise.

The increasing adoption of GLP-1 drugs impacts sectors far beyond healthcare, including apparel, retail, fitness, telehealth, and even insurance. Companies in these industries must understand how the GLP-1 drug market and other emerging weight loss drugs are transforming consumer behavior to capitalize on these shifts.

Weight Loss Drugs Changing Industries Beyond the Health Sector

Telehealth: Enhancing Patient Care and Screening

The telehealth industry has experienced significant growth in response to the skyrocketing demand for GLP-1 medications, particularly those used for weight loss like Wegovy and Ozempic. As millions of people seek out these treatments, telemedicine platforms are emerging as a convenient solution to access these medications without traditional in-person visits.

Furthermore, companies are not just prescribing GLP-1 medications; they’re building comprehensive programs that combine medication with lifestyle counseling and personalized care management.

Among the solutions to ensure accurate screening and ongoing patient care, these platforms use AI-powered tools that provide accurate BMI verification and real-time health tracking. This helps in improving patient outcomes and ensures the proper use of GLP-1 medications.

Incorporating technology that enhances patient engagement through personalized health insights will help telehealth platforms retain clients and optimize treatment plans for weight loss. For instance, telehealth companies like Hims & Hers and Ro have seen massive increases in sales, with weight loss programs anchored by GLP-1 drugs driving growth as high as 213% in the past year.

Fitness and Wellness: A Surge in Health-Conscious Consumers

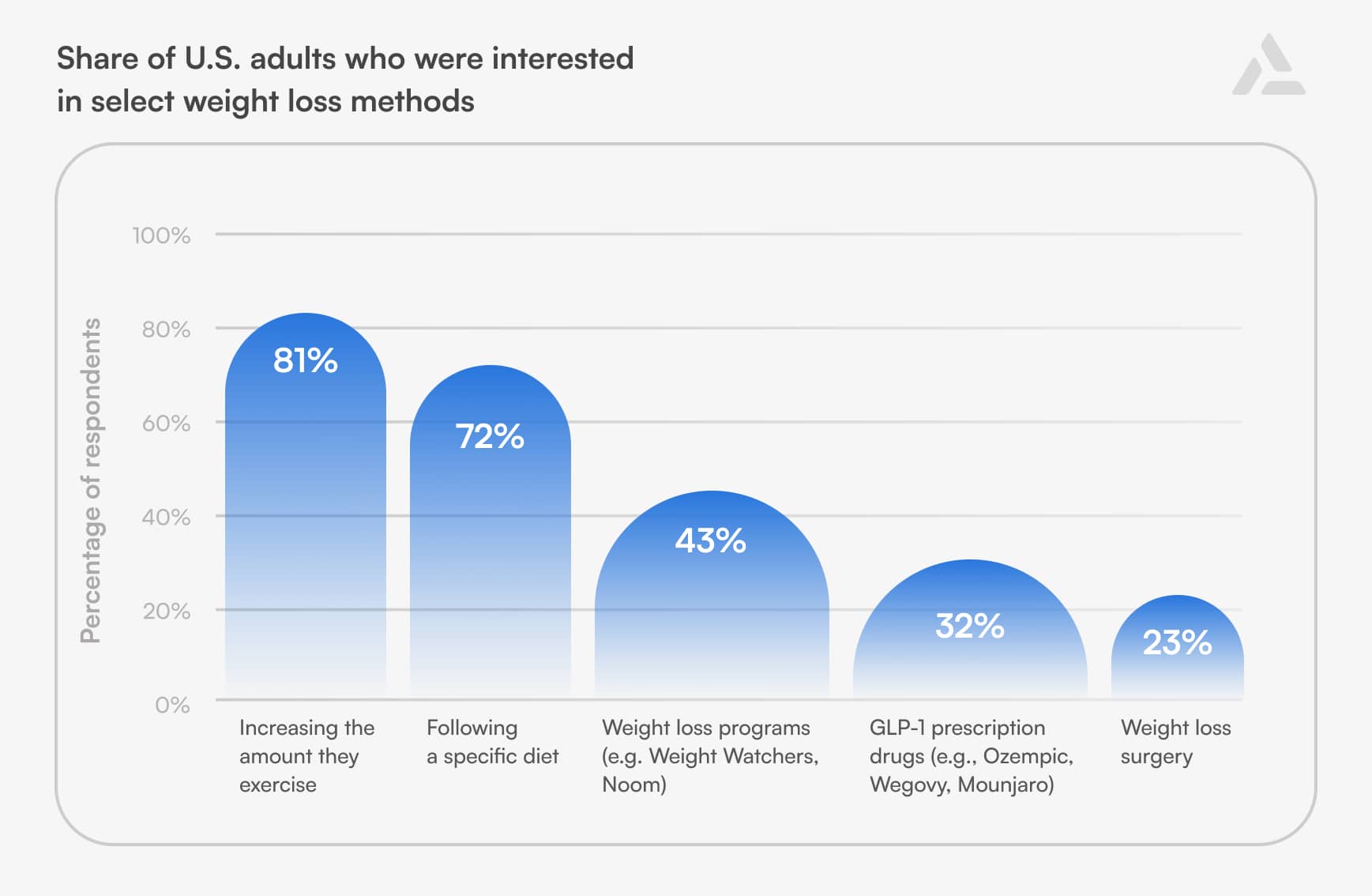

The GLP-1 market growth is driving weight loss but also inspiring consumers to adopt healthier lifestyles. As users shed pounds, many are motivated to increase their physical activity. Several surveys pointed out that GLP-1 users reported exercising more frequently (one of them mentioned 60% of users). This behavioral shift presents significant opportunities for the fitness and wellness industry.

Both digital fitness platforms and traditional gyms are seeing increased interest from consumers seeking personalized workout plans that complement their weight loss journeys. Businesses in the fitness sector can benefit from offering tailored fitness programs, progress-tracking tools, and services that cater to the specific needs of GLP-1 users. The rise in gym memberships, at-home fitness equipment purchases, and fitness app subscriptions signals a growing market opportunity for companies that offer data-driven fitness solutions.

Fitness centers are creating specialized programs designed for individuals using GLP-1 medications. For instance, Equinox has developed exercise routines specifically for those on these drugs to help them maintain muscle mass and overall fitness.

Companies like Life Time and WeightWatchers are incorporating GLP-1 medications into their wellness services. Life Time has acquired weight loss clinics that prescribe these drugs, while WeightWatchers offers membership plans that include access to doctors who can write prescriptions for GLP-1 medications.

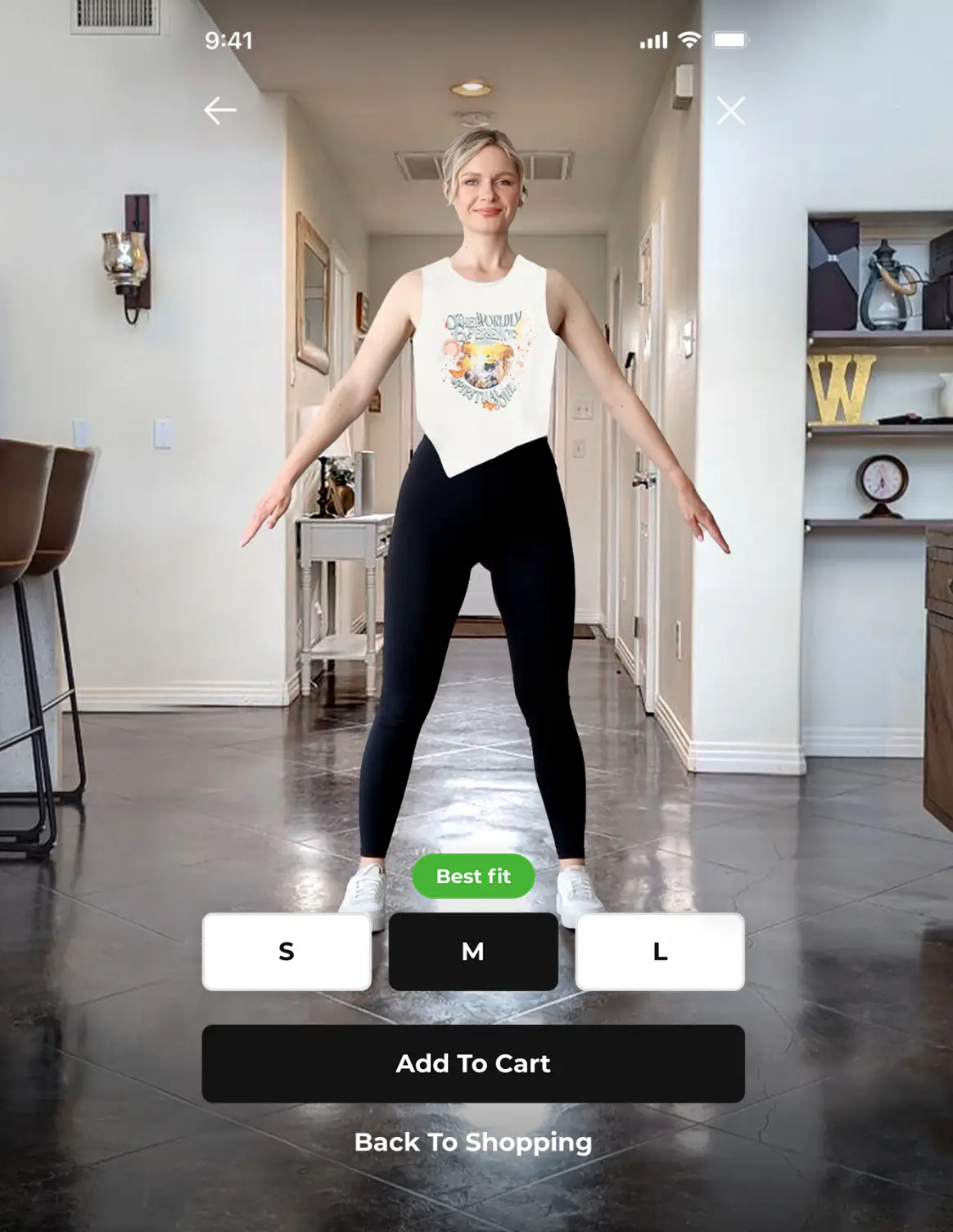

3DLOOK has introduced FitXpress, a weight loss tech that employs cutting-edge body scanning technology to provide users with detailed body measurements and personalized fitness insights. It delivers accurate assessments of body composition, including calculations of metabolic rate and body mass index (BMI) for comprehensive obesity analysis.

Apparel and Retail: The Shrinking Size Curve and the Rise of the Resale Market

As GLP-1 drugs gain popularity, their impact on the apparel and retail sector is becoming more evident. Consumers who use GLP-1 drugs are experiencing significant weight loss, leading them to downsize their clothing. This trend has resulted in a surge of new clothing purchases across different sizes, positively impacting retailers and brands.

Many retailers are seeing a noticeable shift in customer demand for smaller sizes, which also has major implications for inventory planning and profitability.

A report from Impact Analytics estimates that these changing size curves could cost retailers up to $20 million annually due to misaligned inventory and excess production of larger sizes. The shift in size demand, coupled with the need for new inventory, can have significant financial implications for retailers. Misalignment in size curves and inventory mismatches could potentially lead to annual losses in the millions for these businesses.

Apparel companies must adapt by improving their size curve management and integrating solutions that provide real-time data on consumer sizing trends. This involves revising their product lines and marketing strategies to attract consumers undergoing substantial weight loss.

Resale Market Growth: A New Opportunity for Secondhand Fashion Platforms

The rise of GLP-1 drugs is also reshaping the secondhand fashion and resale market. Platforms like Poshmark, The RealReal, and Vestiaire Collective are beginning to see shifts as consumers drop weight and sell off larger-sized clothing, often in favor of purchasing smaller-sized or more form-fitting items.

According to a recent article in Vogue Business, the effects of weight loss drugs like Ozempic are emerging as both a challenge and an opportunity for resale platforms.

- Challenges: a growing supply of larger-sized clothing might flood the resale market, potentially leading to slower sales or oversupply in certain categories. Platforms will need to find ways to manage and balance inventory across sizes, ensuring continued demand for larger garments.

- Opportunities: as consumers downsize their wardrobes, they may increasingly turn to resale platforms to both sell and repurchase items that fit their new body shape. This creates opportunities for platforms to engage new users, provide more personalized resale recommendations, and optimize marketing toward consumers experiencing significant body transformations.

The resale market is already experiencing significant growth, with projections indicating that it will reach $73 billion by 2028. As more consumers shift towards secondhand fashion, the influence of weight loss drugs could accelerate this trend, with brands and platforms having to innovate their strategies to cater to changing consumer behaviors.

Health Insurance: Data-Driven Risk Management

The growing popularity of GLP-1 drugs offers a unique opportunity for health insurance companies. As more consumers lose weight and improve their health metrics, insurers can use data-driven approaches to create personalized health plans. Companies like Cigna, Aetna, and UnitedHealth Group leverage health data from consumers using GLP-1 drugs to reduce risk profiles and offer more targeted plans that reflect the specific needs of policyholders.

The ability to monitor long-term health improvements through precise data, such as changes in BMI, fat percentage, and body composition, will allow insurance companies to provide better services while improving profitability. Health insurance providers can differentiate themselves by offering personalized coverage options for consumers actively working toward weight loss goals.

This approach is also linked with the fact that longevity experts have long pointed out that obesity is linked to a range of serious health issues, from diabetes and heart disease to certain cancers and even Alzheimer’s. Because of this, some doctors are recommending that older adults, especially those over 65, consider GLP-1 drugs like Ozempic to manage their weight but also to improve their overall health and longevity.

Data Platforms: Powering Health Insights and Personalized Solutions

As GLP-1 users continue to adopt these medications, the need for accurate health data tracking grows. Data on weight loss, diabetes management, and other health outcomes is essential for comprehending the long-term effects and effectiveness of these medications.

Data platforms that manage health insights like Meditech—ranging from fitness and telehealth to insurance and nutrition—stand to benefit greatly from the integration of advanced health monitoring tools. This involves monitoring weight, blood sugar levels, and other vital signs to ensure that the medications are performing effectively.

Advanced platforms like Dandelion Health leverage artificial intelligence (AI) and machine learning to analyze clinical notes and imaging. This analysis helps identify patterns and predict patient responses to GLP-1 treatments, ultimately enhancing the effectiveness of precision medicine.

For instance, FitXpress uses advanced body scanning technology and tracks real-time body composition metrics, including BMI, BMR, fat percentage, and lean body mass, enabling fitness and healthcare businesses to offer personalized services and track the health journey of GLP-1 users.

Whether it’s used for EHR systems to enhance patient records, remote patient monitoring (RPM) platforms for real-time health tracking, or corporate wellness programs to boost engagement, FitXpress delivers data that empowers businesses to provide more targeted and effective health solutions.

Additionally, the extensive data generated is driving research and development efforts. Pharmaceutical companies and researchers can leverage this information to create new treatments and enhance existing ones.

Discover how AI-powered body data is revolutionizing health, fitness, and weight management, setting a new standard for personalization and progress tracking.

Nutrition and Food: Evolving Consumer Preferences

In October 2023, Walmart’s quarterly update that revealed a decline in consumer spending on food sent shockwaves through the food industry. Their report mentioned this trend was largely attributed to the rising popularity of GLP-1 medications, particularly Ozempic.

As these people’s dietary habits shift, it leads to a decline in caloric intake and an increased focus on portion control. Major food companies are feeling the impact of reduced consumption driven by GLP-1 medications, with businesses like Kraft Heinz and Campbell’s reporting sales declines over the past year.

In response to these shifts, food companies are diversifying their product lines and placing greater emphasis on health-conscious offerings. Other food companies are responding by offering products tailored to GLP-1 users, with some brands launching meal plans and portion-controlled food options. This trend includes mergers and acquisitions, such as Mars acquiring Kevin’s Natural Foods, to better align with the growing focus on wellness.

Thus, companies that adapt to these changing preferences by offering healthier, customized meal options will likely see increased demand from this growing consumer segment.

The Role of Technology in Supporting Industry Shifts

As businesses in telehealth, fitness, apparel, insurance, nutrition, and data management adapt to the rise of GLP-1 drugs, technology plays a pivotal role in their success. Data-driven solutions are crucial to understanding and catering to the evolving needs of GLP-1 users.

Apart from remote monitoring and data health tracking, wearables like smartwatches and fitness trackers help users get a clear overview of vital signs, physical activity, and dietary habits. This data can help healthcare providers tailor treatment plans and adjust GLP-1 drug dosages as needed.

Apps designed for weight management and diabetes care can integrate with GLP-1 drug regimens. These apps can provide reminders, track medication adherence, and offer personalized health tips based on user data. Advanced data analytics and AI can analyze large datasets to identify patterns and predict outcomes. This leads to optimized treatment plans, a better understanding of patient responses, and overall improving the efficacy of GLP-1 drugs.

This is where companies like 3DLOOK come in.

FitXpress by 3DLOOK offers technology solutions that enable businesses across health and wellness sectors to better manage the impact of the GLP-1 market. With AI-powered smart scales that verify BMI, 3D body scanning for accurate body measurements, and comprehensive health data tracking, FitXpress provides businesses with the tools needed to adapt to changing consumer demands.

The FitXpress AI smart scale feature relies on extensively validated datasets to accurately verify whether a user’s weight input aligns with their body scan measurements. This way, it prevents the misuse of weight loss medications.

Whether in telehealth, fitness, apparel, or insurance, FitXpress helps businesses offer personalized, data-driven services that align with the needs of GLP-1 users.

Final Thoughts

The growth of the GLP-1 market is reshaping industries far beyond healthcare, including telehealth, fitness, apparel, retail, and insurance. As this market continues to expand, businesses across these sectors must be prepared to adapt and capitalize on the opportunities presented by changing consumer habits.