Fashion executives are anticipating a tough year ahead as the global economic slowdown threatens to reverse the industry’s rapid post-pandemic recovery. According to McKinsey’s ‘The State of Fashion’ report, industry leaders believe the prevailing challenge they’ll face in 2025 will be the constant state of uncertainty, mirroring the anticipation of restrained economic expansion, enduring inflationary pressures, and fragility in consumer confidence.

Particularly for enterprise brands, serving customers at scale across numerous channels, responding to market changes in a timely fashion can prove challenging. However, as the turbulence of recent years has shown, those who capitalize on the right opportunities, predicting and planning for future trends in fashion ahead of the curve, can thrive even during the most difficult of times.

Industry executives view fast fashion, brand marketing, and generative AI — which reflect the desires and values of these young consumers — as the biggest opportunities for fashion in 2025, according to McKinsey.

Sustainability and agility have been priorities for fashion for a number of years. However, shoppers don’t just want brands to wait and see what is trending in fashion before they act. Brand differentiation reflects the growing desire for businesses to go above and beyond what is typically expected of them and find exciting, creative and, increasingly, digital ways to grab attention in a competitive fashion market.

Future fashion trends: The industry trends shaping the future of fashion retail

With a focus on meeting increased demand for inclusivity and personalization through technology, ethical and eco-friendly business practices, and engaging customer experiences, these are the trends set to shape the future of fashion retail.

Metaverse

Our digital environments are beginning to evolve from 2D, linear spaces into multi-dimensional, 3D worlds. With young consumers spending vast amounts of time exploring these emerging online spaces — from virtual reality environments to popular online games such as Roblox — the metaverse is tipped for exponential growth in the coming years.

As these online worlds materialize, users will desire to personalize their online personas, offering new opportunities for fashion to explore.

With 63% of Gen Z consumers expressing a strong interest in the metaverse and among those the most likely to spend on digital garments, according to Sina, many brands are already starting to explore this trend, partnering with leading video game developers to bring their garments to the online world. Fortnite players can now dress their avatar in trendy Balenciaga outfits, while Roblox players spend thousands on virtual Gucci accessories.

Others are venturing into fashion NFTs (Non-fungible tokens) — virtual assets, which govern ownership of digital items such as images, videos, or in-game items — with brands such as Dolce & Gabbana generating millions from exclusive digital collections. Meanwhile, emerging trendsetters such as DressX and The Fabricant, are showcasing the potential of digital garments that customers can ‘wear’ through augmented reality (AR).

Social shopping

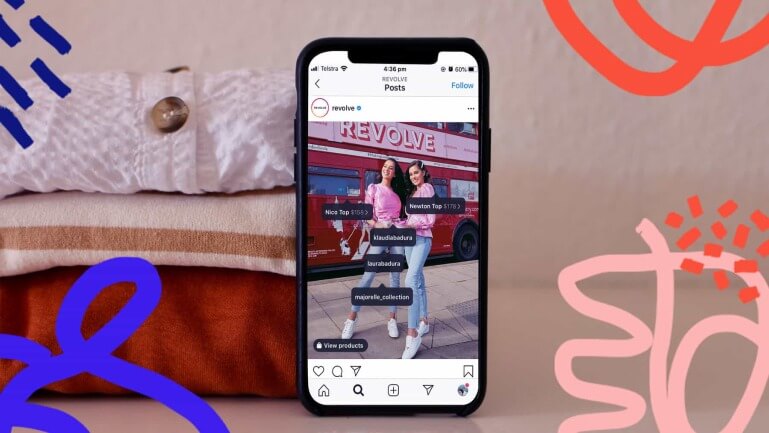

Today, many consumers turn to social platforms in search of support and guidance, analyzing the outfits of influencers on Instagram and TikTok, combing through user-curated boards on Pinterest, and sending snaps through Snapchat asking for advice.

The pandemic has accelerated reliance on social media, with 74% now more influenced to shop through these channels than they were before the pandemic, according to Business of Fashion (BOF) and McKinsey, while 70% highlighted clothing as the product they shop for most.

Third-generation retailers have focused on cultivating sizable, deeply engaged, steadfast communities. Shein’s intricate affiliate marketing influencer scheme, coupled with authentic social community development, has propelled exponential user expansion. Temu has also been concentrating its resources on marketing endeavors to facilitate rapid expansion, exhibiting over four times the amount of Amazon’s Facebook advertisements in the US.

As consumers explore new social shopping channels, annual social commerce sales are expected to surge by 51% in the US over the next two years, reaching $56bn. By 2027, worldwide social commerce sales are estimated to total $600bn.

Authentic influencers – a new fashion retailing trend

The BoF-McKinsey State of Fashion 2024 Consumer Survey disclosed that 68 percent of respondents expressed discontent regarding the inundation of sponsored content across social media platforms, while 65% indicated a decreasing reliance on fashion influencers compared to previous years. Particularly, young consumers like Gen-Z turn to banner blindness in just 1.3 seconds.

Despite these discouraging numbers, influencers still remain brands’ powerful tactic to penetrate the clutter and establish connections with consumers. Nonetheless, the influencer landscape has been transforming in recent years. As consumers increasingly prioritize authenticity, entertainment, and relatable personas, authentic and relatable influencer marketing will be one of the fashion industry’s trends in 2025.

As per the BoF-McKinsey consumer survey, consumers are gravitating towards relatable and authentic influencers far more than other attributes such as an aspirational lifestyle or celebrity status.

Experiential retail

The demand for personalized retail experiences is growing.

Some 80% of consumers now expect fashion retailing businesses to accommodate their preferences, with brands turning to technology to reshape their customer experience (CX).

Artificial intelligence, in particular, is playing a leading role. In stores, trendsetters such as Amazon are exploring the potential of cashier-less checkouts that streamline the buying process. This technology tracks customers, recognizes the products they select, and bills them automatically as they leave.

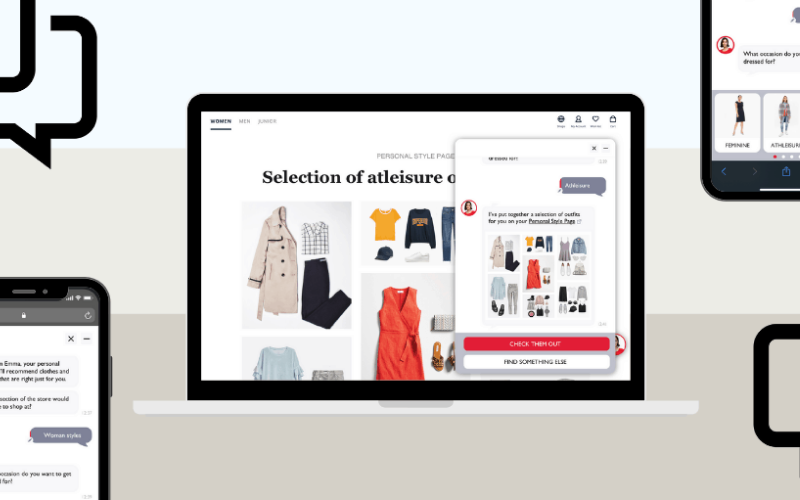

Online AI technology is providing new, efficient ways to communicate with customers. Chatbots, for instance, can now answer customer queries and help them find products instantly without the support of a customer service operator. Through the KIK messaging platform, H&M’s chatbot asks customers questions about their clothing preferences and provides personalized recommendations based on their responses. With 40% of Gen Z and Millennial customers preferring to speak to a chatbot over a human representative when in a hurry, according to Zendesk, the demand for these solutions is growing.

Likewise, the number of voice assistants in use globally was set to double from 4.2bn in 2020 to 8.4bn in 2024, with 43% of those with access to the technology using it to shop, according to Review42. In recent years, Amazon has begun to allow a select few industries to create their own intelligent assistants powered by its Alexa voice technology. In the fashion space, the leading retailer envisions an online clothing shopping experience where customers can seek styling advice and recommendations through voice features created by brands. Voice e-commerce is becoming big business with transactions tipped to reach $19.4bn this year by Juniper Research.

Fit technology

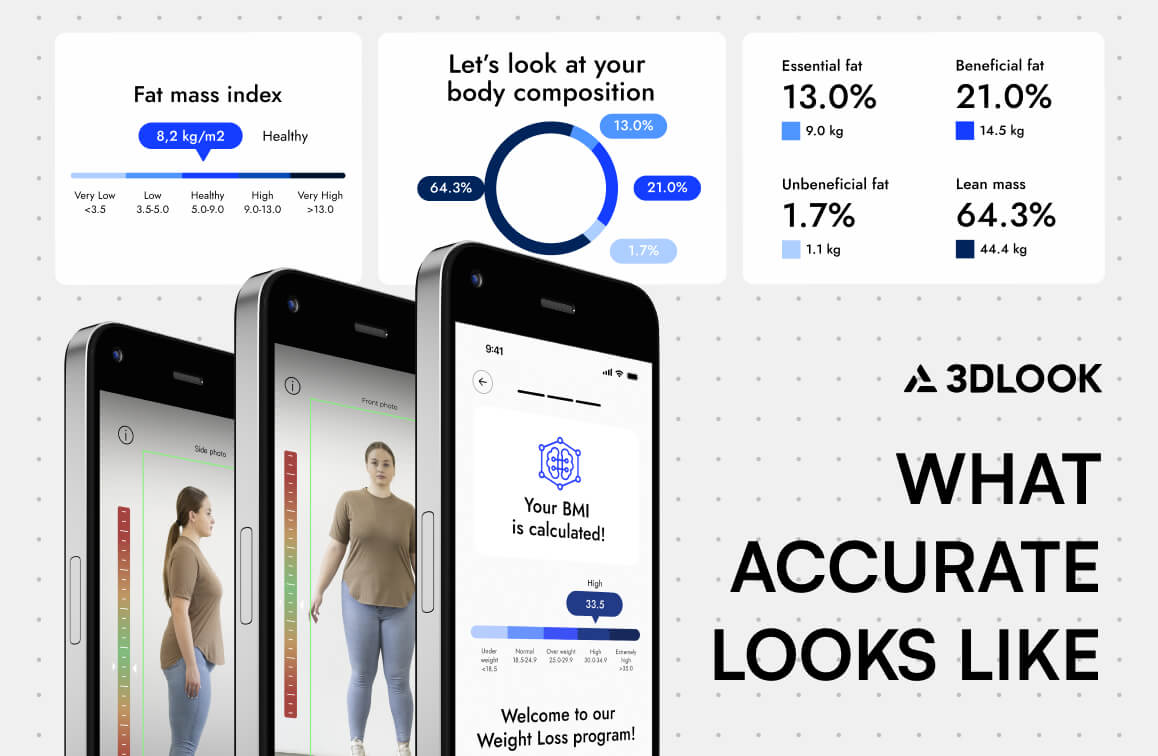

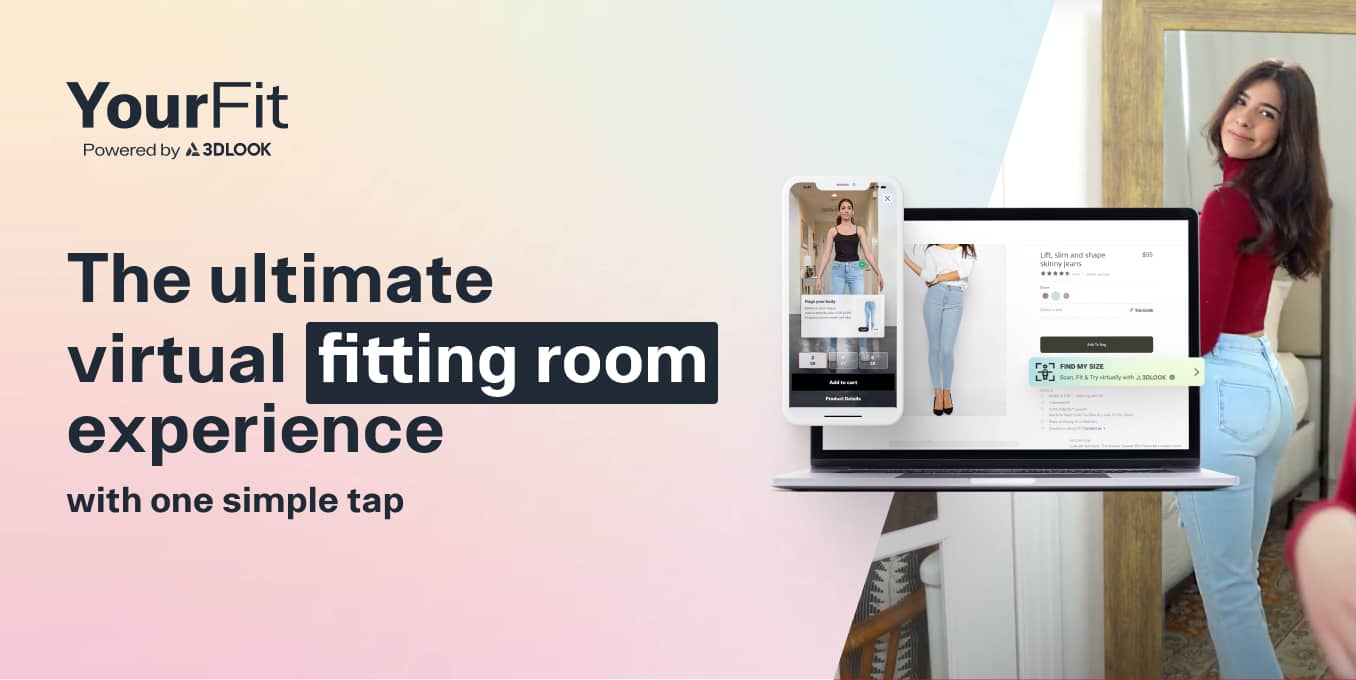

Mobile body scanning technology is also having a transformative impact on businesses of all shapes and sizes. Solutions such as Mobile Tailor, which allows businesses to collect body measurements contactless and remotely using just two photos of the customer, are enabling made-to-measure businesses to expand their reach and provide a safe and comfortable in-store measuring process. Likewise, solutions such as YourFit are overcoming fashion e-commerce’s sizing challenges by matching online shoppers with their perfect size and fit.

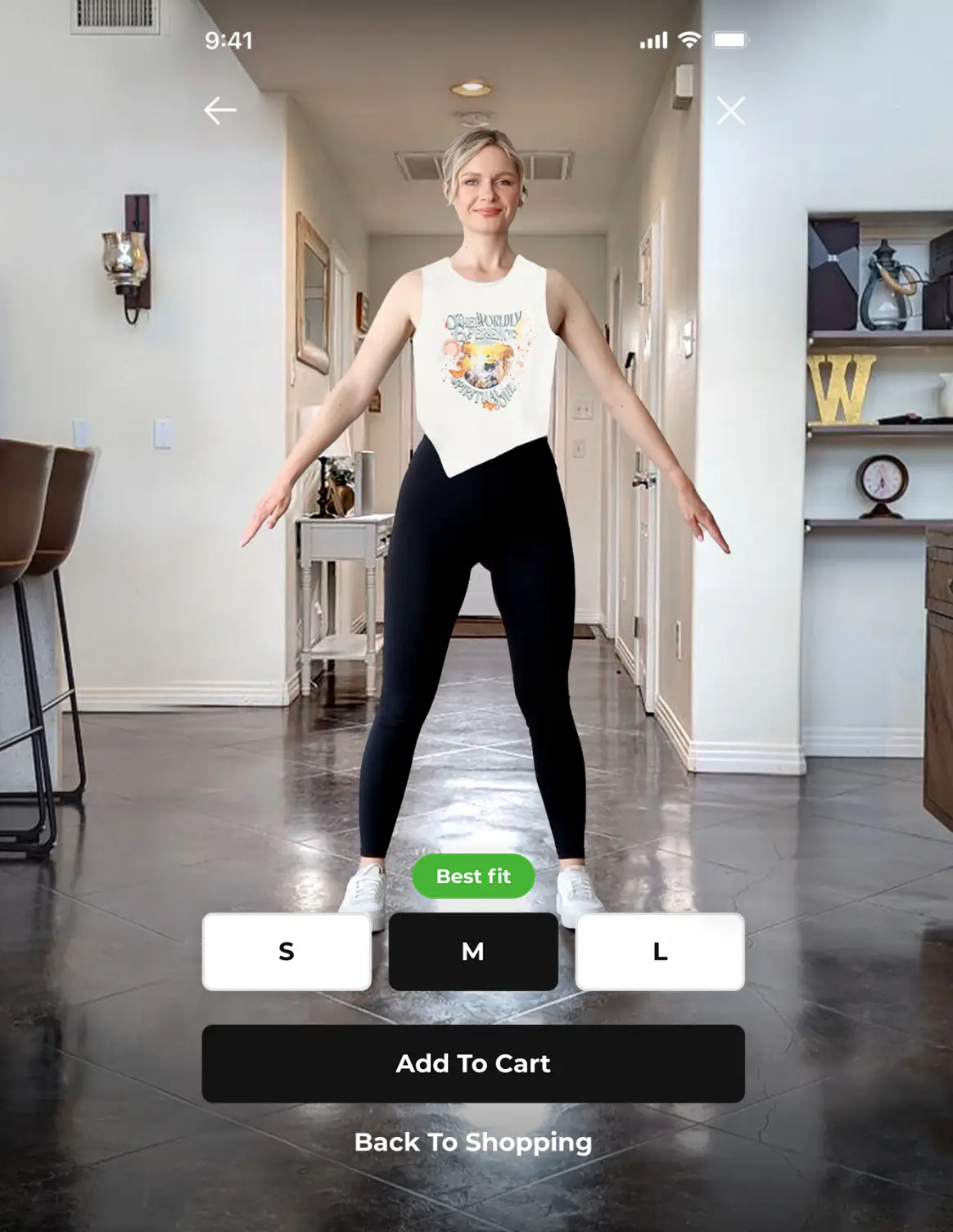

With 71% of consumers willing to shop more with brands that incorporate AR into the customer journey, retailers are exploring this too. Soon, magic mirrors could become the norm on shop floors, allowing customers to visualize garments on their bodies without getting undressed. Likewise, solutions such as YourFit are bringing the fitting room to the online world, providing tailored size recommendations combined with an engaging, photo-realistic try-on experience, powered by highly accurate body measuring technology.

Channel diversification

Ecommerce grew at an extraordinary rate during the pandemic and has continued to gain ground in the years since. As the market normalizes, brands will need to carefully reconsider their channel strategies based on emerging future trends in fashion.

To continue growing, retailers must expand and diversify their mix, taking advantage of emerging channels such as marketplaces to reach new audiences. Many brands are exploring partnerships with marketplaces such as Zalando and Farfetch, while traditional brick and mortar retailers such as Macy’s and Walmart have launched their own in the hopes of capitalizing on this fashion retailing trend.

However, brands shouldn’t just be looking online — Two years ago, physical store openings in the US topped closures for the first time in three years, so brick-and-mortar fashion retail will continue to thrive in 2025 as well. It makes sense, with the pandemic having slashed rents in many key markets and the cost of online advertising on the up.

However, rather than a place solely to shop, these physical touchpoints will increasingly provide a space to bring brands alive and connect with customers. To do so, digitalization will still be crucial with customers desiring differentiation. Platforms such as YourFit can enhance the in-store experience, for example. Using a combination of NFC and RFID technology, shoppers can tap and scan their body through their smartphone as they browse in-store, providing a unique and engaging customer experience.

Circular textiles

Fashion’s struggles with sustainability are well documented: A leading cause of harmful emissions, shocking water consumption, and approximately 40 million tonnes of textile waste each year. With half of young consumers planning to buy fewer, better quality garments, the industry must explore slow, sustainable and circular manufacturing processes and materials.

Sustainability-focused retailers such as the Pangaia are exploring the potential of alternative textiles. The London-based apparel brand recently introduced two 100% bio-based alternatives to its material line-up — “PlntFiber” and “FrutFiber” — made from renewable and biodegradable plant blends and agricultural waste. Many are beginning to work with natural fibers, such as hemp, bamboo and ramie as cotton alternatives. Meanwhile, brands such as Stella McCartney have pioneered closed-loop solutions using innovative materials such as bio-based fur, which requires up to 30% less energy to produce and causes 63% less greenhouse gas than conventional synthetics. Likewise, leather alternatives, such as muskin, are helping to reduce the use of environmentally-damaging chemicals during production.

With consumers, regulators and stakeholders becoming increasingly wary of attempts at greenwashing, enterprise fashion brands will need to take meaningful action to clean up the industry, and demonstrate a shared commitment to tackling environmental and social issues.

Regulatory action will only increase the sense of urgency. This year, for instance, the New York State Senate will vote on whether to pass the ‘Fashion Sustainability and Social Accountability Act’, which would require global apparel and footwear companies with revenues exceeding $100m doing business in the state to map their supply chain, disclose their environmental and social footprint, and set out plans to reduce their impact. Likewise, businesses would also have to disclose their material production volumes and make this information available online, providing many companies with the push they will need to clean up their supply chains.

Supply chain innovation

While executives view agility as one of the biggest opportunities to attract customers in 2025, supply chain disruptions – from raw material shortages to clogged up ports and postal strikes – pose a problem.

While disruptive, these issues could prove to be a catalyst for positive change. To provide the agility enterprise fashion retail businesses and their customers seek, the manufacturing sectors are exploring new, digitally-enabled supply chain models. According to McKinsey, some 65% of businesses are considering nearshoring, where manufacturers relocate operations to countries closer to the brands and business they serve to reduce logistics times, cost and delays. Likewise, 61% are exploring the possibility of forming strategic partnerships with suppliers.

However, 20% are taking the opposite approach and, instead, are looking to reduce the number of partners involved in the production process. Vertical integration sees manufacturers directly take on parts of the process that would have been outsourced to a third party. For example, last year, US textile manufacturer Mount Vernon Mills purchased a yarn spinning and weaving facility from Wade Manufacturing Company to exercise greater control over its production. This strategy allows manufacturers to streamline their operations, helping to cut costs, improve margins and reduce delays.

Second-hand fashion

The global fashion resale market is set to grow 127% by 2026 and is expanding three times faster than the wider fashion retail sector, according to ThredUp. Recent growth has been largely fueled by the growing demand for sustainability, yet second-hand fashion will receive a further boost in 2025 as younger consumers curb their spending amid the financial downturn.

According to McKinsey, in the US, 76% of Gen Z and 79% of Millennials are withdrawing their savings, taking on credit and finding additional jobs to manage their finances. Undoubtedly, many will seek out resale, rental and upcycled fashion to keep their spending in check. ThredUp research shows that 63% that already shop resale do so to save money.

For some time, young consumers in China have been using platforms such as Xianyu and Zhuanzhuan to buy and sell second-hand fashion, while we’ve also seen the explosive growth of platforms such as Depop in the Western markets.

Big enterprise retailers – who have enough expertize and data to spot what is trending in fashion ahead of the curve – have seen the value in resale — In 2021, Farfetch announced the acquisition of resale technology platform Luxclusif, while luxury fashion group Kering purchased apparel marketplace Vestiaire Collective last year. Now, they are set to be rewarded for their investment as shoppers opt for second-hand.

Fast fashion

“Fast-fashion competition will likely become even fiercer in the year ahead.”

(McKinsey, The State of Fashion 2024 report)

The report notes that 40% of consumers in the United States and 26% in the United Kingdom have made purchases from fast fashion behemoths Shein or Temu within the last year. If you consider other fast fashion establishments, the figure is likely to be considerably higher.

The fast fashion market size was estimated to grow from $122.98 billion in 2023 to $142.06 billion in 2024, with a growth rate of 15.5%, according to The Business Research Company.

Despite its growth, fast fashion is often criticized for its significant waste. Fast fashion customers demonstrate a tendency to dispose of clothing rapidly: certain approximations suggest that consumers regard the cheapest garments as almost disposable, discarding them after merely seven uses.

For this reason, emerging fast fashion retailers like Shein and Temu are revolutionizing the fast fashion industry through these strategies:

- Dynamic and expandable supply chains link manufacturers directly to consumers. Some next-gen fast fashion enterprises have established extensive networks of suppliers who primarily produce for these companies.

- Usage of data-driven methods for product design and evaluation. For example, Shein incorporates various data inputs ranging from prevailing trends to viral products and customer perceptions.

- Cultivation of devoted and expanding customer communities that are nurtured through affiliate marketing influencer initiatives and organic social engagement efforts.

- Implementation of high adoption rates for mobile apps and engagement strategies, like gamification elements via apps, encouraging users to attend live streams, and more.

Product passports

In order to improve sustainability and transparency while tackling long-standing issues such as counterfeiting, brands plan to invest in solutions that will help maintain and share product information digitally.

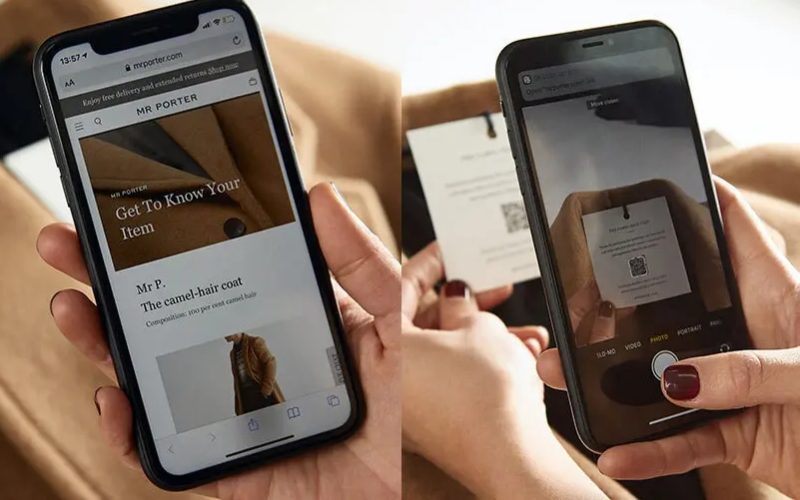

Known as ‘product passports’, these solutions leverage technologies such as blockchain, radiofrequency identification (RFID), QR codes and near-field communication (NFC) to assign a unique identifier to each garment, store valuable information, and enable access to that information over the web.

Product passports can store information on materials, how and where a garment was made, and working conditions in said factories, offering greater transparency to eco- and ethically-conscious partners and customers.

Using systems such as Eon’s Connected Product Platform, retailers such as Net-a-Porter are assigning ‘Digital IDs’ to their products, which customers can scan to access information on provenance and design, and instructions on maximizing the longevity of the garment. This technology is set to play a leading role in the future of fashion, with governmental organizations such the European Union reviewing plans to introduce the technology to consumer goods that would allow the origin of materials and components used during manufacturing to be tracked.

Diversity and inclusivity

Some 42% of insiders rate fashion’s performance as ‘poor’ or ‘very poor’ in prioritizing diversity and inclusivity (D&I) as a core value, according to BOF. However, there are signs of positive change — A recent Council of Fashion Designers of America survey found most industry employees believe fashion’s attitudes towards D&I are ‘evolving’ and ‘improving’.

But there’s still plenty to improve. In 2021, plus-size clothing made up just 21% of the US fashion market, despite 70% of women wearing size 14 and up, according to Coresight Research. This represents a huge growth opportunity for brands. However, in the years ahead, improving D&I will be less about growing profits and more about sustaining them. According to McKinsey, 75% of young consumers will boycott brands that they judge to discriminate against races or sexualities, for instance.

Brands such as 1822 Denim are leading the way in creating a more inclusive fashion industry, offering 100 different styles in sizes ranging from 00 to 24W. Using 3DLOOK’s YourFit, 1822 Denim customers can scan their body and receive a tailored size and fit recommendation, helping those that have long been overlooked to find garments they love.

Looking ahead, brands must focus less on serving specific categories and instead blur the lines between menswear and womenswear. With 50% of Gen Z consumers having purchased a fashion product from a category that doesn’t conform with their gender identity, brands will need to rethink product design, marketing and customer experience to offer greater gender fluidity.

Future trends in fashion: Why technology in fashion retail is crucial to long-term success

Gen Z shoppers aren’t easy to please — According to a recent Qualtrics study, just 47% of these young shoppers are likely to rate a retail experience as positive, compared to 60% of consumers overall. And they’re more than willing to turn their backs on those retailers that fail to meet their high standards.

With Gen Z now making up 40% of global consumers, according to McKinsey, accounting for $150bn in spending in the US alone, appeasing their demands for greater personalization, inclusivity, transparency and sustainability is crucial – and technology will be key.

From digital retail experiences that make every customer feel valued and included, to product passports that allow them to track the impact of the products they buy, technology in fashion retail can create a customer journey that engages and encourages the modern consumer.

Other future fashion predictions include a new and more authentic influencer landscape and AI’s vast applicability across the fashion value chain.

A sustainable, inclusive & personalized future of fashion: Embracing digital transformation in fashion retail

These trends will shape the future of fashion retail, but why wait to make changes that will help make the industry more green, personal, and inclusive?

Using tools such as YourFit, businesses can implement positive digital transformation in fashion retail today. Combining personalized size recommendations with virtual try-on technology and body data analytics, retailers can overcome the consumer sizing challenge, provide a fun and engaging shopping experience, and lead the way in sustainable practices — all through one easy-to-implement solution.

Additionally, the advent of 3D body scanning is positioned to revolutionize the retail and apparel, sectors, reshaping the way consumers approach shopping. With 3DLOOK’s Mobile Tailor, the process of digitizing measurements becomes effortlessly streamlined, ensuring companies receive unparalleled accuracy and consistency in record time.

Tackle inefficiencies in fashion and do your part to create a better tomorrow — Speak to a 3DLOOK expert to find a solution that supports your brand goals and objectives.

YourFit

A simple, user-friendly, and intuitive fit personalization platform that helps shoppers find the best size clothing while also providing an engaging try-on experience.