There will be plenty of fashion challenges facing the industry in 2025. From economic uncertainty to age-old problems such as sky-high returns, these are issues fashion must contend with.

Fashion is in for a difficult year, with forecasts for 2025 predicting a global slowdown as economic pressure grows.

With consumers tightening their budgets as the cost of living rises, sky-high inflation weighing heavily on brands, and intensified concern around issues such as sustainability, inclusivity, fair pay and working conditions, businesses cannot afford to let their guard down.

To maintain a positive trend in 2025, businesses must ensure that they are acting in the interest of all stakeholders — investors, employees, customers and society alike — and commit to overcoming issues such as environmental impact, lacking diversity, and distrust while navigating the short-term economic challenges.

3DLOOK’s team of experts answer ‘what are the current challenges facing the fashion retail industry?’, detail the biggest fashion industry challenges businesses face and provide tips on how to overcome them.

2025’s fashion challenges: What are the current challenges facing the fashion retail industry?

1. The talent deficit

Fashion’s public image offers jobseekers little encouragement, with concern over environmental and social impact limiting appeal. Half of all professionals in the apparel industry feel as though fashion’s desirability has fallen since 2019, according to Business of Fashion, due to its poor sustainability credentials and reluctance to change.

To attract talent, the apparel industry must increase minimum wage, eliminate unpaid internships, and hire from wider circles. For instance, LVMH committed to training 25,000 young people from all backgrounds through internships, apprenticeships and permanent opportunities.

Businesses must also appease post-pandemic desires by continuing to offer flexibility. Fashion house Tapestry, for example, will allow employees to continue working from home.

Yet, overall, the intricate landscape of global fashion manufacturing is transforming. Manufacturers, notably those originating from conventional centers such as India, are extending their operational reach into novel territories, including Africa, the Middle East, Turkey, and Latin America. This strategic shift is orchestrated to surmount geographical constraints and harness advantages like reduced labor expenses, access to raw materials, and proximity to consumer markets in Europe, the UK, and the Americas.

The impetus behind this geographical diversification is, in part, a calculated response to the supply chain disruptions precipitated by the pandemic. By dispersing their manufacturing footholds, fashion brands endeavor to diminish reliance on established hubs, heading to nearshoring and reshoring. These avenues promise heightened resilience and expedited turnaround times, aligning with the imperative of adaptability in the face of global challenges.

This same respect must be shown throughout supply chains; with 64% of Millennials shunning employers that demonstrate poor social responsibility, according to Cone Communications, low wages and poor conditions in supplier factories must be addressed.

AI’s Impact on Fashion Talent

The imminent transformation in manufacturing due to automation, where robots and AI-powered machines are poised to take on tasks ranging from cutting and sewing to finishing and folding. This shift, driven by the pursuit of increased efficiency, accuracy, and cost reduction, offers fashion businesses a means to better meet the demands of a rapidly evolving market.

However, the move towards automation prompts essential questions about the future of the workforce. As machines assume responsibilities traditionally handled by humans, a revised workforce strategy is needed.

This strategy should prioritize reskilling and upskilling across various roles, spanning designers and technical teams to factory workers and managers. This approach ensures effective collaboration with and utilization of these new technologies. A balanced approach would include both technological advancement and the human element in the industry.

2. The sustainability gap

Fashion ranks among the world’s most polluting industries, contributing 8-10% of global carbon emissions, according to the UN.

With consumers demanding improvements and regulatory action such as New York’s ‘Fashion Sustainability and Social Accountability Act’ adding pressure, 15% of fashion executives cite sustainability as a top-three concern, according to McKinsey.

With 70%+ of emissions resulting from manufacturing, businesses must turn to sustainable materials that are recyclable, regenerative and responsibly sourced. Lululemon has committed to using 75% recycled polyester, which will cut emissions by 45%, for instance.

Adopting on-demand manufacturing models will also be crucial. Slow fashion marketplace MIVE, supported by 3DLOOK’s mobile body measuring tool, has created an emissions-free process where every garment is produced according to the customer’s precise measurements. This eliminates overproduction, minimizes returns, and drastically cuts emissions.

Request a Demo3. Unnecessary textile waste

Despite the significant environmental cost of producing garments, much of it is deposited into a landfill within 12 months. Globally, fashion creates 40 million tons of textile waste annually, according to the Ellen MacArthur Foundation, and much of it is unnecessary — despite cotton’s recyclable nature, less than 1% of cotton materials were recycled in 2020.

If fashion is to reduce its volume of waste, it will require closed-loop systems that keep garments in constant circulation. To achieve this will require changes to the way garments are designed, with a focus not only on recyclability but also on the ease of collecting and sorting.

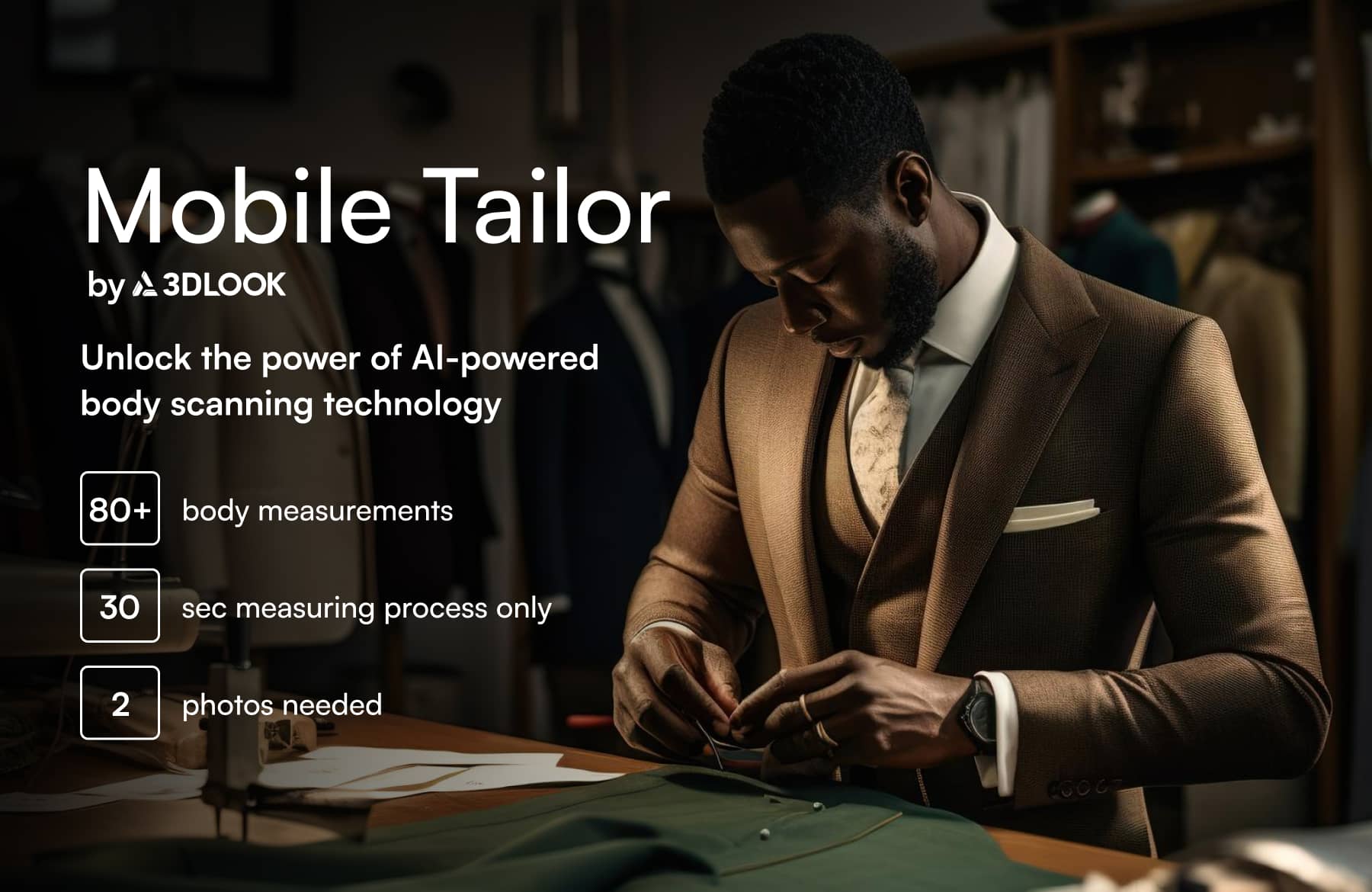

Additionally, 3DLOOK’s Mobile Tailor helps fashion brands reduce carbon emissions linked with the transportation and return of ill-fitting items. Mobile Tailor is a digital embodiment measurement solution curated for retailers looking to provide precise dimensions of their clientele for bespoke or on-demand garment enterprises. This innovative solution facilitates an easy approach to digitizing the capture of measurements, ensuring swift acquisition of accurate and consistent data, whether customers transact in brick-and-mortar establishments or the digital realm.

Through the integration of Mobile Tailor, brands can furnish a convenient and sustainable shopping sojourn, adeptly catering to consumers’ evolving requirements.

Gen Z and Millennial shoppers are expected to drive the industry’s recovery, with fashion among the top three categories where they are set to spend. However, attracting these customers will require a commitment to innovation. In fact, according to Context Consulting, half would prefer greater technology use in retail over lower prices.

Leading brands are beginning to explore opportunities such as blockchain and digital fashion as interest grows in fashion NFTs and virtual worlds. With 71% of consumers willing to shop more with brands that incorporate augmented reality into the customer journey, this is an area retailers must also consider.

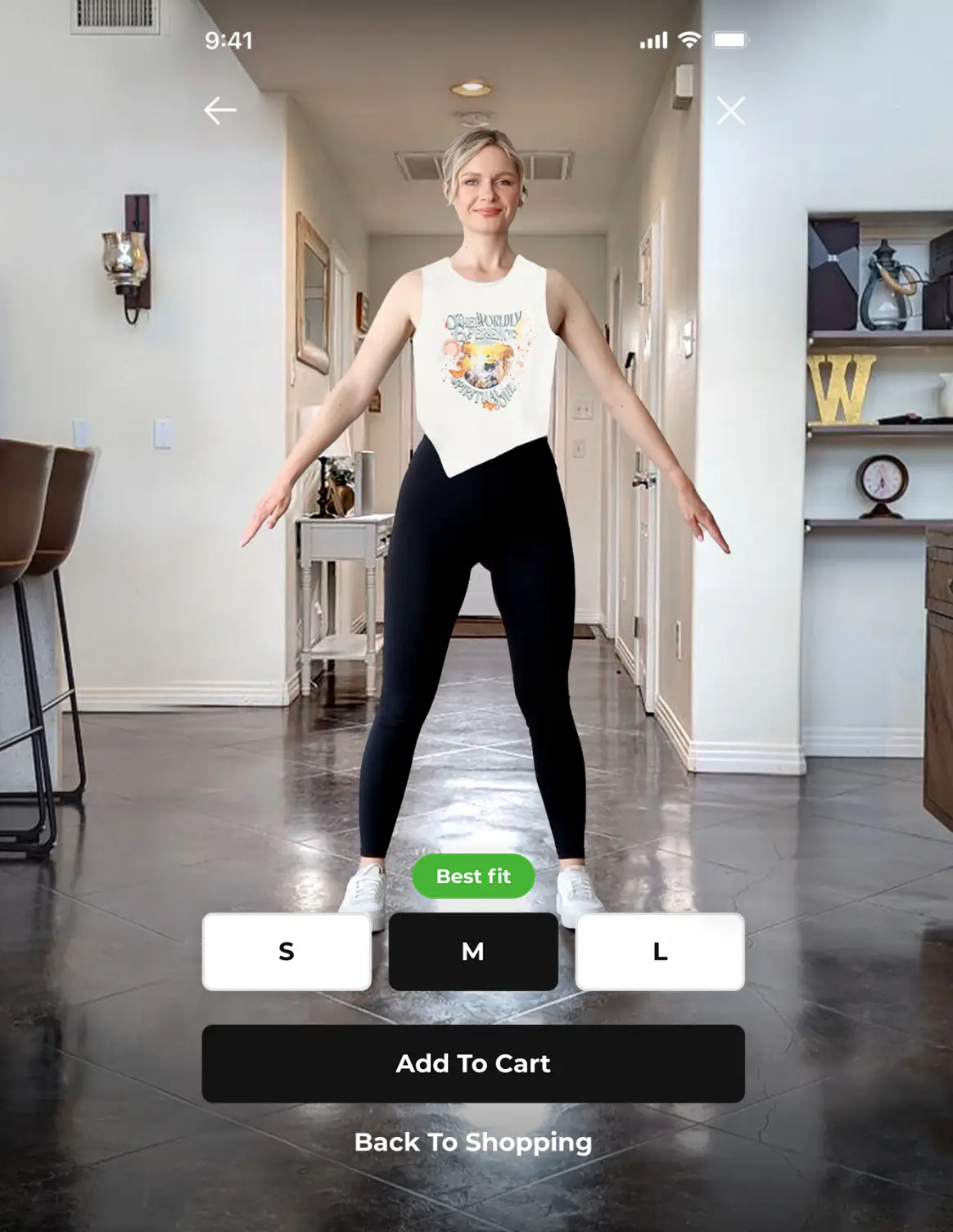

Virtual try-on tools, such as YourFit, allow customers to visualize garments on their body without getting undressed, providing the convenient, engaging, personalized experience that modern consumers desire.

5. Supply chain bottlenecks

Fashion’s intricate supply chain is suffering from unprecedented disruption, from material scarcities to staffing shortages, logistical delays, and the energy crisis.

Combined, these issues push up the cost of manufacturing and distribution, impacting the profitability of many apparel brands. According to McKinsey, the worldwide fashion industry is poised to manifest low single-digit growth expansion in 2025. However, these growth projections entail variations at both regional and country levels.

To minimize disruption, companies must rethink their sourcing strategies and build greater flexibility into their supply chains. Brands should work with suppliers to scale up nearshoring, moving manufacturing operations closer to its customers to avoid material supply bottlenecks, minimize shipping costs, and continue providing near-instant delivery.

6. Spiralling returns

The pandemic caused a spike in e-commerce shopping rates. However, customers are also returning a larger portion of purchases, with 20.8% of goods now returned on average, according to the National Retail Federation — up 96% since 2020.

Fashion must take action to reverse this trend, with 30-40% of online fashion purchases typically returned, according to PwC.

To reduce fashion e-commerce return rates, brands must analyze their returns data to uncover patterns and learn customer behaviors and characteristics that are likely contributing to the issue. More often than not, retailers will find product clarity is the primary issue, with up to 26% of returns due to poor fit or style. Here, practices such as importing visuals, providing comprehensive sizing information, and implementing features such as live chat to assist customers in finding their right size can help.

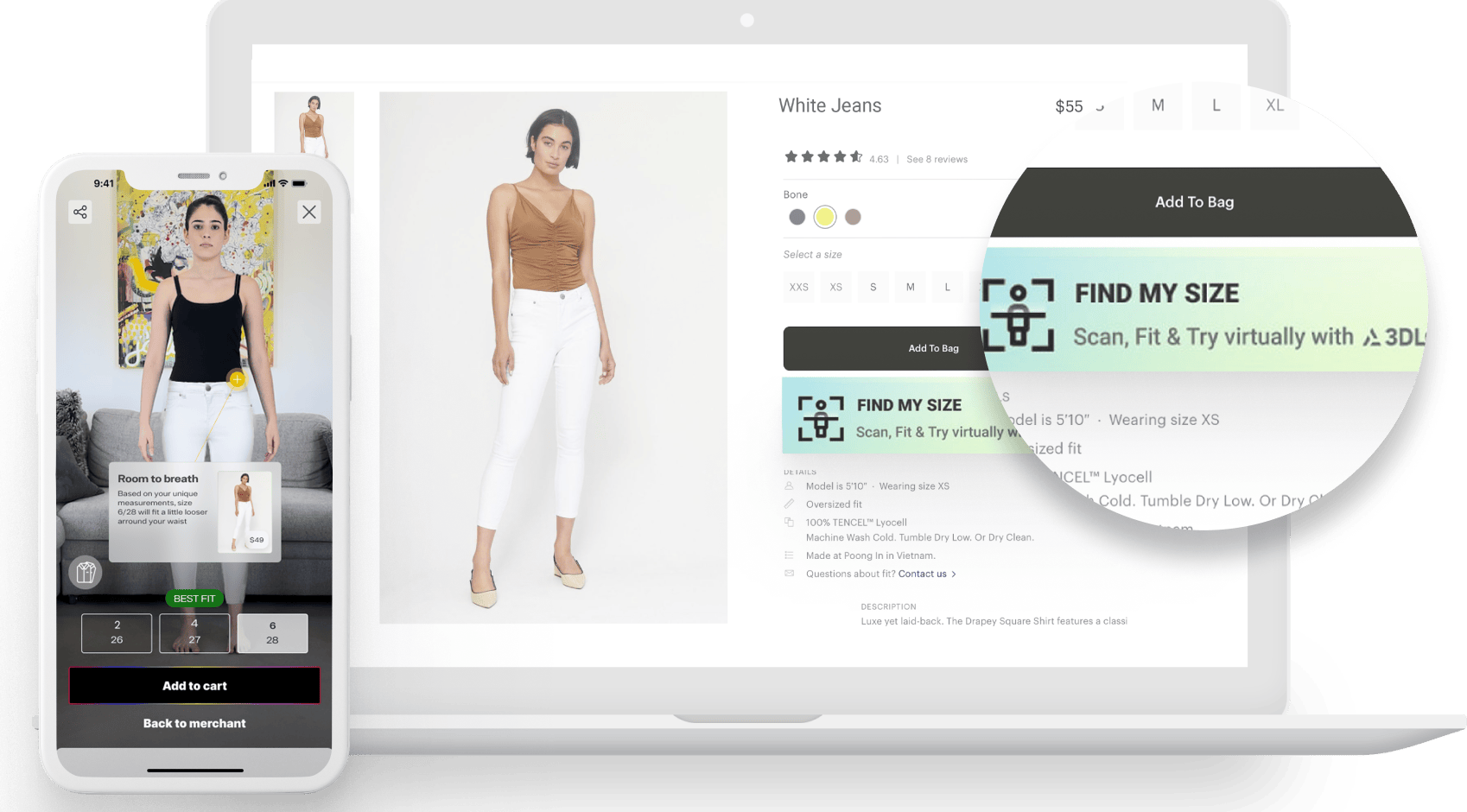

However, innovative retailers are leveraging fit technology, such as 3DLOOK’s YourFit tool, to help customers find products they love that fit right. When using the tool, which relies on a combination of computer vision, 3D matching technologies, and machine learning, retail fashion businesses can offer customers personalized, trustworthy size and fit recommendations and a photorealistic virtual try-on experience from just two photos. Using YourFit, brands have cut return rates by up to 40%.

Request a Demo7. Rising distrust

As much as 60% of fashion’s eco-claims have been classed as ‘unsubstantiated or misleading’ by the Changing Markets Foundation. With fashion among the industries trusted least by consumers, according to Edelman, brands must find ways to back up their sustainability claims.

Demonstrating progress will be particularly important to young consumers, according to Cotton Incorporated, with 64% actively seeking companies with solid sustainability reputations based on a Simon Kucher report.

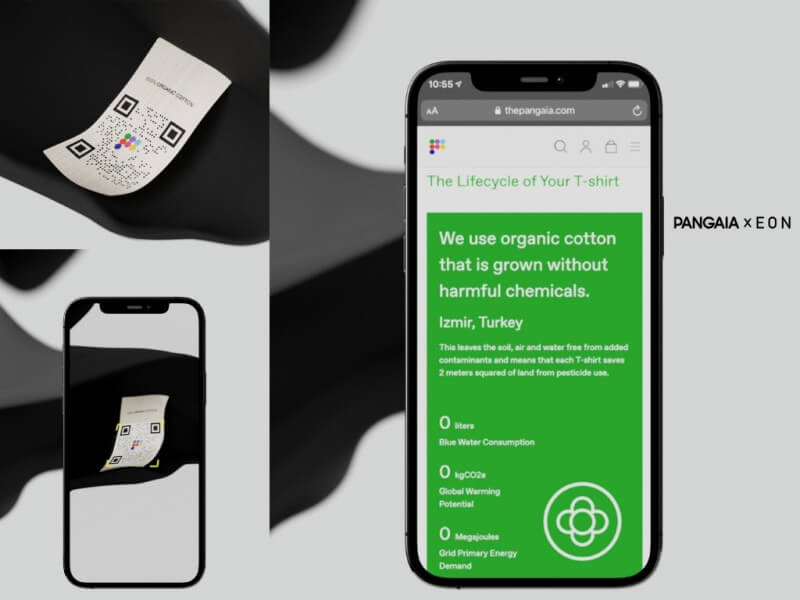

To rebuild trust, brands must improve traceability and transparency. Blockchain-enabled product passports can share information with consumers, such as materials used, manufacturing processes, and supplier working conditions. Retailers such as Pangaia are already demonstrating this potential, while political organizations such as the European Union are considering the deployment of the technology at scale in 2025.

Standardization can also help — the Higg Index, for instance, provides a standardized way for brands to measure environmental and social impact across a product’s life cycle.

8. Diversity and inclusion

Some 42% of fashion professionals say the industry is ‘poor’ at prioritizing diversity and inclusion, according to BoF.

Fashion’s lack of diversity shows in the products it sells — plus-size makes up just 19% of the US fashion market for women, according to PR Newswire, despite serving 70% of women. Likewise, 35% of non-binary people feel unable to wear work attire that accurately represents their gender expression.

Building diverse teams and involving employees in key decision-making processes will be vital. Diversity from within the company will help brands to understand the needs of the complex fashion market, and ensure products and marketing truly serves the consumer base.

Brands such as Nordstrom have begun to publish detailed employee demographic information, highlighting underrepresented groups and challenging themselves to improve.

9. Size and fit

Sizing continues to pose a significant problem for fashion consumers, with 62% struggling to find clothing that fits.

A lack of standardization causes confusion among consumers, and vanity sizing — assigning smaller sizes to make consumers feel good — complicates the issue. As shoppers move online, with a lack of dressing room to try on garments, the problem is complicated further.

To overcome the issue, womenswear brand Denim 1822 has created over 100 different jean styles and offers sizes ranging from 00 to 24W. Using 3DLOOK’s YourFit, 1822 Denim scans customers’ bodies to intricately match them to their perfect size and fit. 92% of customers have expressed satisfaction with the recommendations they received, with conversions up and returns down.

10. Building cyber resilience

As big data in fashion retail reaches new heights, so too does the risk of brand-damaging cyber attacks. Retail is the fourth most targeted industry, with the average breach costing retailers $3.48m, according to IBM.

The loss of trust can add millions more to the cost. Likewise, regulatory acts such as California’s Consumer Privacy Act can result in huge fines for targeted businesses.

Brands should be prepared to address one of the most delicate problems in the fashion industry and the appropriate solutions include staying compliant with the latest data privacy rules. Never has it been more important to build cyber resilience in fashion retail. Brands must allocate a greater proportion of their budgets to cybersecurity and, as well as seek support from specialist firms, build in-house cyber competency.

With the threat landscape constantly evolving, brands must actively monitor cyber risk throughout the value chain and consider how data is handled — from collection to use and disposal.

11. Inflation and economic downturn

Faced with record-high inflation, inflated energy costs, constant talk of a cost of living crisis and worrying geopolitical tensions, consumer confidence is rapidly falling. According to NielsenHQ, consumer spending will increase in 2025, but purchases of essential goods will drive the majority of growth.

While consumers are projected to spend more on non-essential items compared to 2024, this shift shows a mix of caution and optimism, as people carefully navigate economic conditions while gradually returning to spending habits seen before the pandemic.

To protect bottom lines, over 50% of fashion executives have already increased prices in 2024. In 2025, the fashion industry is expected to stay slow, much like in 2024. Revenue growth is predicted to remain low, only increasing by a small amount, according to McKinsey. However, with consumer purchasing power falling, this risks pricing out shoppers and damage loyalty by forcing them to seek more affordable options elsewhere.

A pivotal focal point for fashion retailers will revolve around the astute administration of expenses and inventories intricately intertwined with strategic pricing methods. Rather, to protect themselves as the global economy recovers, enterprise retailers must focus on reducing avoidable costs throughout the business.

The adoption of sophisticated financial management tools will turn into a strategic advantage. This fiscal dexterity empowers manufacturers to seize the opportunities presented by emerging trends, adeptly pivot in response to market changes, and engender value in an environment where consumer preferences undergo perpetual evolution.

This methodology transcends the conventional realm of cost containment; it delves into adeptly using financial tools, fostering agility in a market characterized by fierce competition and dynamic shifts in consumer choices.

Return loss is one area where brands could make significant savings, as is overproduction — Using YourFit, retailers can improve their production, planning and distribution processes to ensure belt-tightening consumers have access to products they will love, buy and keep.

Those brands and suppliers that deftly navigate these shifts, harnessing the prowess of contemporary financial and accounting tools to refine their strategies, are poised to endure and flourish. The capability to dynamically calibrate pricing strategies based on market trends and consumer insights, coupled with adept inventory management to curtail wastage and optimize sales, becomes the hallmark of leaders in this fiercely competitive domain.

Overcoming 2025’s biggest fashion industry challenges

With industry experts anticipating a tough year for fashion, challenges will be abundant, from long-term struggles such as sustainability and sizing struggles to growing issues such as diversity and distrust.

However, having survived one of the most difficult periods the fashion industry has ever faced during the pandemic, businesses have proven themselves capable of persevering. By adapting to changing consumer behavior, listening to the concerns of customers and colleagues, and investing in the right solutions and software, apparel industry businesses can overcome the challenges 2025 throws at them.

Get in touch to discover how 3DLOOK’s fit personalization platform can help your brand overcome 2025’s biggest fashion challenges.

YOURFIT

A simple, user-friendly, and intuitive fit personalization platform that helps shoppers find the best size clothing while also providing an engaging try-on experience!