The average return rate of clothing in the US apparel market sits at 20.8%, with rates having risen by more than 50% since 2020 according to the National Retail Federation and Appriss Retail. This is often discounted as a cost of doing business. However, with the rapid growth of fashion ecommerce, apparel return rates could soon become unsustainable if retailers are unable to find solutions.

What is the average return rate on clothing purchased online?

Ecommerce offers customers the ability to shop from anywhere at any time, but what it provides in convenience is lost to the lack of ability to see, feel and wear an item before purchasing.

As if losing one in ten purchases isn’t bad enough, the sky-high online clothing return rate means that ecommerce fashion retailers face far greater losses. According to Forrester, the average return rate of clothing purchased online totaled 30% in 2021. According to Eco-Age, average rates may even be as high as 40%, while KPMG found that up to 50% may be the norm for clothing retailers following the holiday period.

Return rates by industry: How do apparel return rates compare?

Returns are inevitable in every industry, but fashion is disproportionately affected — Not only do products need to function well, but they also need to meet the subjective fit and style expectations of a diverse range of customers. Unsurprisingly, according to Shippo and Loop, 80% of those that have returned an online purchase previously have sent back an apparel product.

According to Statista, consumers are more likely to return apparel than any other product type, with 26% having returned an item of clothing in the past 12 months. Shoes (18%), bags (17%) and accessories (13%) make up the top four. In comparison, just 11% of respondents had returned electronics. Some 9% had sent back beauty and cosmetic products, while 7% returned entertainment items such as books, music, movies and video games.

The causes of sky-high online apparel return rates

There are a multitude of reasons why a customer might change their mind about a purchase. However, the high average return rate of ecommerce clothing likely has a lot to do with shoppers’ inability to see a product before they buy it. They can’t check if the size is right, the product is undamaged or that the color or pattern compliments their look. Instead, they’re forced to accept the uncertainty and hope for the best.

The complexity of sizing

According to Statista, size was by far the biggest cause of apparel ecommerce returns last year. It’s understandable — Sizing is complex and bodies are diverse. With fashion suffering from a lack of standardization, consumers must typically rely on endless lists of product dimensions and the unreliability of self-measuring when shopping online. Unsurprisingly, the results often fail to live up to expectations.

The sizing issues faced will differ depending on the products a retailer stocks. A recent study by Tessuti found that for men’s online apparel companies, return rates are most commonly caused by clothing that fits too small, the source of 23% of returns. For womenswear brands, clothing is most likely to be sent back because it’s too big, which is the cause 22% of the time. Likewise, the children’s clothing category provides similar figures to the return rates in men’s apparel, with 31% of returns due to items being too small and 16% too big.

A lack of transparency

Some 16% of consumers have had to return online apparel purchases that didn’t resemble the item shown on the product page. Understandably, retailers want to present their products in the best light, but enhanced imagery and overstated descriptions can often inflate expectations to a level that reality cannot possibly match.

Damage and defects

When purchasing off the rack, shoppers have the luxury of checking for loose threads, dodgy prints, holes and tears. When purchasing online, they have no idea what quality they will receive until it’s in their hands. Whether the result of a manufacturing error, warehouse damage or mishandling during the shipping process, 13% of online apparel returns are the result of customers receiving faulty goods.

Buyer’s remorse

Some 8% of shoppers returned an online apparel purchase simply because they changed their mind. We’ve all been there. We purchase clothing that doesn’t fit our usual style and when it arrives, we soon realize we wouldn’t be caught dead wearing it out in public.

But just as often, returns aren’t due to a dislike for the item. According to Shopify, we’re likely to spend more on fashion than any other category when shopping online in 2023. With our closets already full to the brim, we buy items we want but don’t need, which leads to feelings of regret and anxiety that push us to send some both.

But often, it’s simply because customers know they can…

With 86% of consumers stating that free returns strengthen their loyalty to a brand and keep them coming back, according to Klarna, lenient return policies have become an industry standard… and consumers are taking full advantage. Instead of searching through sizing charts to determine their correct size, half purchase multiple variants of the same product knowing they can simply return those that don’t fit. Essentially, these customers are making the most of permissive returns policies to transform their bedrooms into pop-up fitting rooms — entirely at the retailer’s expense.

If only there was a way to provide customers with their very own at-home fitting room without resorting to free shipping and lenient policies… such as YourFit, 3DLOOK’s complete virtual sizing platform.

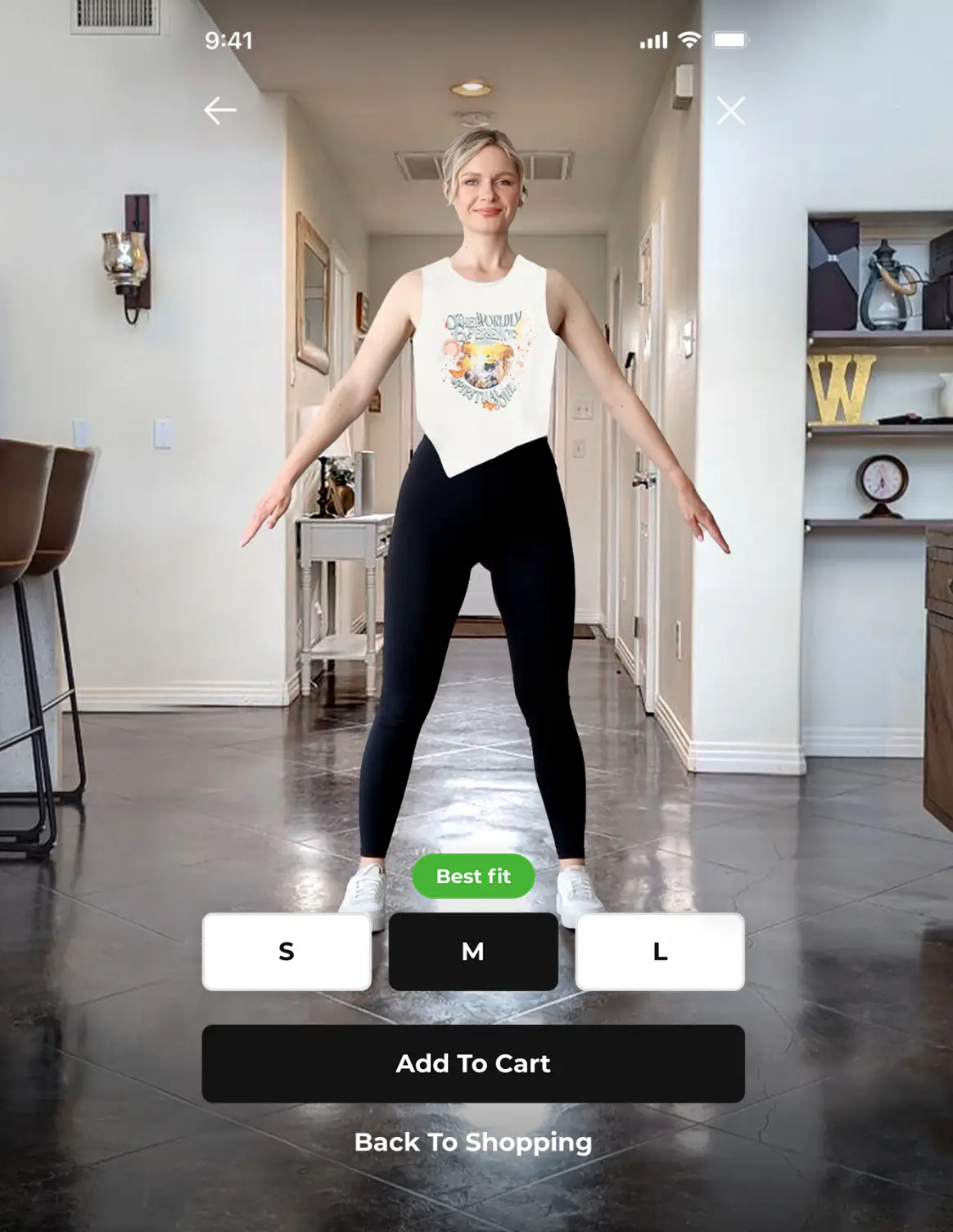

YourFit offers shoppers the ability to effortlessly scan themselves, receive tailored size guidance and view items on their own body through a unique combination of AI-calculated size recommendations and a photorealistic virtual try-on. Customers know what size they need and what to expect BEFORE they purchase, saving them time otherwise wasted trying on and shipping back items they don’t like, and retailers on the astronomical cost of returns.

👉 Discover the full benefits of YourFit and cut the cost of your returns process

The cost of returns to online retailers

NRF figures show that online sales surpassed $1 trillion in the United States in 2021, a milestone that pre-pandemic trends suggested wouldn’t occur until 2024. With this spike in sales comes a surge in unwanted purchases, but exactly how much do apparel returns cost the industry? Well, NRF estimates that $218bn (20.8%) worth of goods bought online were returned in 2021.

While the majority of these returns were legitimate, an estimated 10.6% were deemed fraudulent, costing online retailers $23.2bn. Return fraud doesn’t just include returning stolen or counterfeit goods. One of the most common forms of return fraud is bracketing, where consumers purchase items that they have no intention of keeping — a practice that 63% of consumers regularly resort to when shopping online, according to Navar. Statista data shows that 48% of shoppers bracket their purchases when sizing is unclear, 36% when they’re unable to try products in-store, 26% when they’re unfamiliar with a brand and 23% because their weight has changed. Consumers aren’t intending to cause harm to the brands they shop with, but they are. As reported by Vogue Business, almost 15% of returned online purchases from multi-brand retailers were attributed to bracketing.

For consumers, it might not seem that returns are all that big of a deal. They’ve tried on the items – just like they would have had they shopped in a physical store – and shipped back those they didn’t like to be sold to the next customer. Yet, research by Gartner found that less than half of returns are resold at full-price, despite only 20% being defective according to Optoro.

The reality is, Optoro estimates, retailers face losing $33 for every $50 worth of goods a customer ships back and with each day that passes, the harder it is for retailers to recoup their costs. Apparel is particularly vulnerable to loss of value given the short window in which items stay in style. With a new fashion season coming every three months, items shipped back at the very end of a 30-day return window leaves little time to process, restock and resell returned goods before the next collection hits the racks.

The additional costs of high apparel return rates (and how retailers can reduce them)

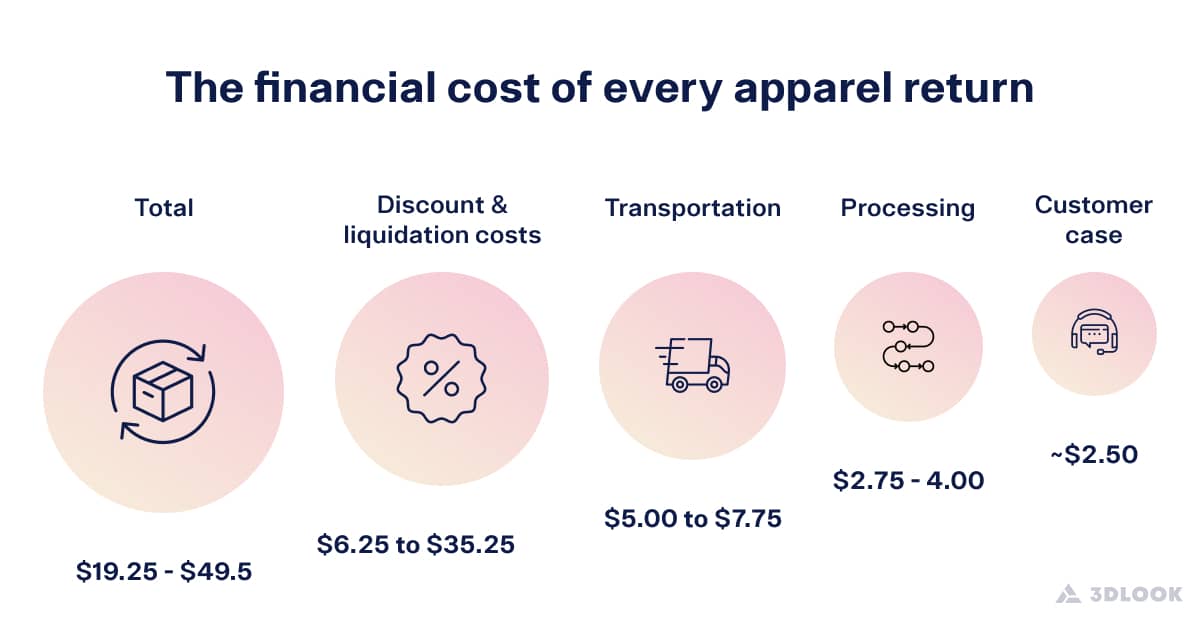

You receive a return, restock it and sell it again. No harm done, right? Only you’ve paid for shipping three times, polluting the atmosphere in the process. Processing it costs you valuable time and resources and you might’ve lost yourself a lifelong customer. There’s far more to returns than simply reselling an unwanted item and, only if you’re lucky, you might just break even.

Logistics

Even if a product can be resold at full price, retailers still owe their logistics provider for not only delivering the item, but now also for returning it. Optoro data shows that for every $50 purchase that gets returned, retailers typically lose between 10% and 15% of the value.

However, many are turning to automation to minimize the costs of return logistics. There are plenty of tools that offer integration with various shipping providers through one streamlined platform, allowing retailers to compare rates and services, and print labels in bulk at discounted rates. This ensures that every return offers the speed and convenience customers expect at the cheapest possible cost.

Processing

Retailers require warehouse space to hold the mountains of stock that customers ship back. Before items can go back on sale, they must first be checked to ensure they’re clean and undamaged. Even if the item arrives back at the warehouse in pristine condition, is processed quickly and put back on sale with plenty of time before the season ends, restocking, repackaging and redistributing still adds to the retailer’s mounting expenses. According to Optoro research, this process costs retailers between $2.75 to $4 per item.

Alternatively, returning an item through a third-party logistics (3PL) provider typically costs retailers the shipping fee plus a processing cost of $1 to $3.50 per item according to Deliverr, saving retailers up to 75% of the cost. A 3PL provider will process, restock or dispose of goods returned to their sorting facility depending on your policies, which is perfect for retailers that lack the space, time or resources to maintain a timely and error-free returns process. This also offers benefits such as access to better shipping rates and the ability to scale as required without significant investment.

Customer service

Past research by Bizrate Insights found that close to three quarters of consumers expect to receive credit for their refunded purchases within five days after it reaches the retailer. And just like they want to know when their order is processed and dispatched following a purchase, they also want confirmation when their return has been received, processed and resolved. Unhappy and uninformed shoppers will turn to customer service to complain, and every minute spent understanding their issues and addressing their concerns chips away at that customer’s lifetime value (CLV). More returns means more complaints and more resources required to deal with them. With the average customer service representative earning $17.75/hour in the US, that’s $0.30 for every minute spent on the line.

According to Klarna, the biggest pain points in the returns process are slow refunds (36%), return labels (25%) and the inconvenience of shipping (23%). Thankfully, there’s an abundance of return management plugins available that utilize automation to ease the burden on retailers and their customers. These apps process returns in seconds based on predefined rules, generate shipping labels in a few clicks and automatically handle the process to maximize revenue retention.

Customer loyalty

For every unhappy customer that picks up the phone to complain, there’s 19 more than won’t bother. Sure, the poor fit or damaged product they received was likely just a one-off. Yet, Klarna’s research shows that the vast majority of online shoppers will turn their back on a retailer following an unsatisfactory returns experience. With no second chances, retailers cannot afford even a single mistake.

It’s understandable — Customers aren’t purchasing your products and returning them for the fun of it. To ensure customers aren’t lost before your brand has really had time to prove itself, data is crucial. Seek feedback from those returning goods, analyze the data and find solutions to those most costly churn-inducing issues.

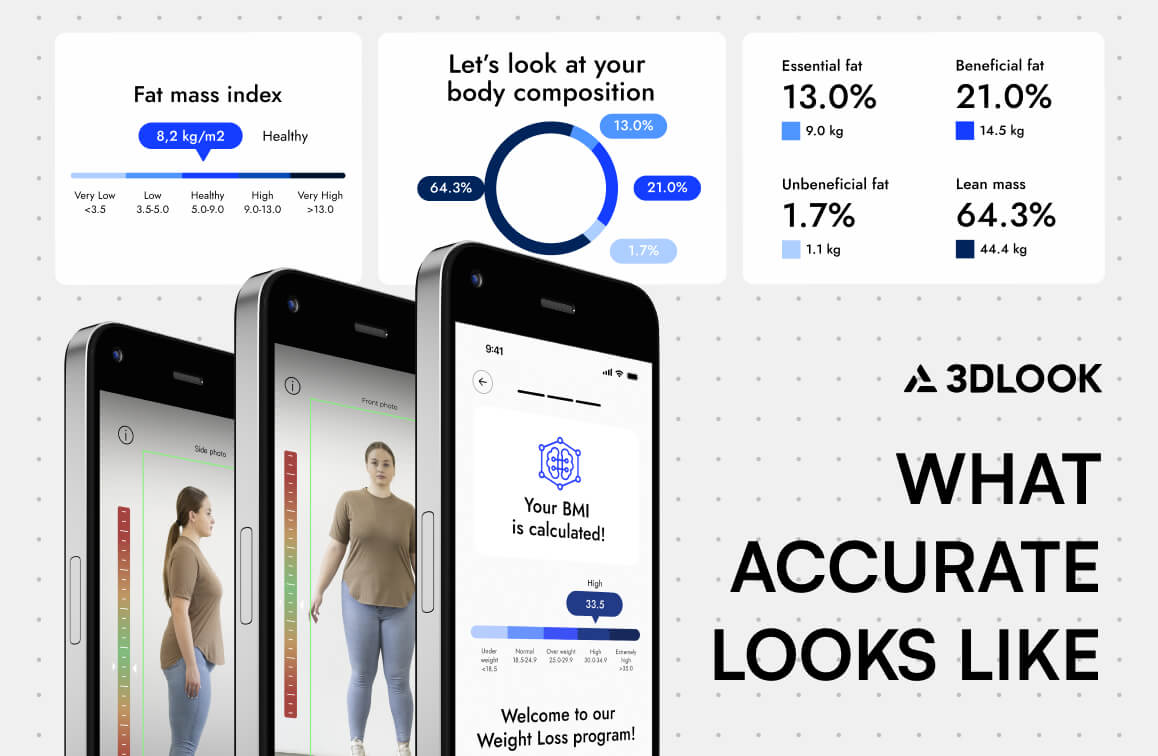

For most apparel ecommerce stores, sizing will almost certainly be the primary problem. Where choosing a size when shopping online was once complicated and inconvenient, YourFit transforms the process into a highly-engaging part of the customer journey that shoppers no longer dread. Plus, using 3DLOOK’s YourFit Body Shape Analytics, retailers can analyze the body data of their customer base to tailor designs, grading rules and inventories to their most frequent shoppers.

Reputational damage

One lost customer might not put a huge dent in a retailer’s profits, but what if they share their dissatisfaction with everyone they know? Research shows that 13% of unsatisfied customers will share their negative experience with 15 or more people. Likewise, as reported by Mindly Support, customers who have a negative experience are 2-3x more likely to leave a review than those who have a positive one. With 72% of shoppers choosing products based on a brand’s reputation, according to Bazaar Voice, too many poor reviews could cause serious long-term damage to a brand’s bottom line.

However, retailers can also use reviews to their advantage. To give shoppers a clearer idea of whether a product will meet their size expectations, brands can incorporate size, height, bust size and age into the review submission process and allow customers to filter based on this information.

Customers don’t care that an L fits more like an M. Their concern is that it doesn’t fit. If customers are able to find out that they will need a slightly larger or smaller size easily before purchasing, then a return is far less likely.

Acquisition costs

According to Shopify, it costs apparel businesses $129 on average to acquire a single customer. Should that shopper request a refund and vow never to shop with your business again, not only are you losing that sale, but also the money you paid to acquire their custom. And now you must do it all over again in order to recoup just a fraction of your losses.

We’ve established that reputation is everything, so put the work in to grow your brand name and build authority by engaging customers through social media. Creating powerful content that educates consumers, builds trust and puts your products front and center still requires time and resources, but it’s far less costly than paid advertising — and it will still be doing its job when the marketing budget runs dry.

Sustainability

Ecommerce’s sky-high clothing return rates aren’t just bad for profits. They’re also terrible for our planet. All those unwanted items need to be shipped across the country from customer to processing facility to warehouse on the back of gas-guzzling trucks. Every year, this process pollutes our atmosphere with 16 million metric tons of carbon dioxide research by Optoro and the Environmental Capital Group shows. And often, it’s all for nothing given 5.8 billion pounds of returned inventory – deemed unsuitable for restocking – ends up in landfill anyway.

Solutions such as rewarding customers that decide to keep their unwanted items with partial refunds have been proposed — According to a recent report by Pymnts, 49% of customers would keep a planned return due to size, color or style in exchange for a 30% discount. Yet, in this situation, nobody really wins. The retailer has handed away their profit, the customer has gained yet another item they don’t like and won’t wear, and it’s only so long before it’s shipped off to landfill at our environment’s expense.

To tackle the issue, retailers need to find an alternative to free returns without damaging customer loyalty by adding on additional charges. YourFit offers consumers clear insight into how a product will look and fit their unique body shape without resorting to returns. With shoppers finally able to try on clothing without venturing to a physical store, retailers can make sky-high size- and style-related returns a thing of the past. Using YourFit, inclusive swimwear brand TA3 SWIM has shrunk its size-related return rate by 47%.

Returns are inevitable, but…

There’s always going to be customers that buy products on a whim and return them because they didn’t read the product description properly, felt guilty about their purchase or simply changed their mind. It happens, and all you can do is keep these customers informed, make the process straightforward and – if you suspect a case of return fraud – take action to protect your business.

When selling apparel online, return rates will never quite reach zero. However, by optimizing your store, you can at least minimize the chances and cut the costs. Yes, returns are part of the cost of doing business, but don’t let it be the end of yours. From improving product clarity to streamlining the return process and eliminating sizing struggles using innovative platforms such as YourFit, retailers can keep costs down AND keep customers happy.

Further reading:

How to reduce returns in e-commerce: fashion retailer’s best practices