Tailored Brands and 1822 Denim Among Global Leaders Using Company’s AI-Powered Fit Solutions to Drive Down Apparel Returns and Boost Conversion

3DLOOK, the global leader in AI-first mobile body measuring and fit solutions, today announced that it has raised $6.5 million in Series A funding, led by Almaz Capital with participation from TMT Investments and Zubr Capital. The investment brings the company’s total fundraising to date to $11.2 million. The new funds will be used to expand 3DLOOK’s US leadership team and establish new R&D labs in the US and Western Europe as the company continues building the fastest and most engaging camera-enabled personalized shopping experiences for consumers and delivering advanced body data analytics to enterprise companies. Tailored Brands and 1822 Denim are among the leading global fashion retailers that are using 3DLOOK’s solutions to drive down apparel returns and increase conversion.

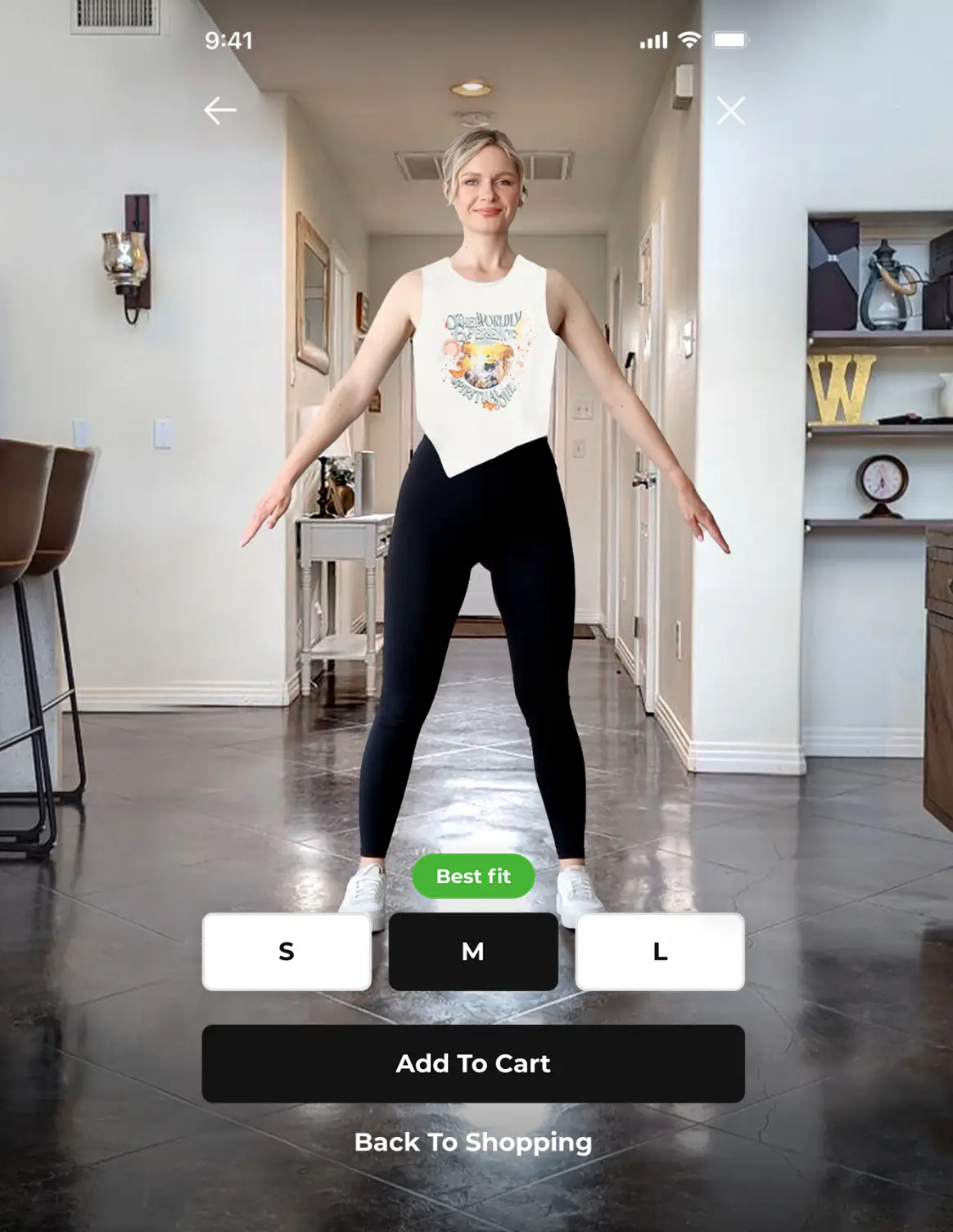

3DLOOK’s mobile camera–based solutions provide personalized fit and size recommendations for online shoppers and body data intelligence that brands can use to create better-fitting clothes. The technology uses a patented combination of computer vision and 3D statistical modeling to instantly measure the human body using just two photos. Brands that use 3DLOOK’s solutions have seen 30% decreases in return rates, while increasing conversions 4 times year over year.

“This successful fundraising round will allow us to expand the use of our AI-first technology to drive personalization across a wide range of industries,” said Vadim Rogovskiy, Co-Founder and CEO, 3DLOOK. “While leading fashion and uniform brands are already relying on our solutions to meet their customers’ fit needs, our growth strategy includes extending into other segments to enable personalized, made-to-measure furniture and car seats; better tracking of health and fitness progress in apps; the creation of personal avatars in video games; and real-time virtual try-ons in AR.”

“We believe that COVID-19 has been the most disruptive event in the last decade to impact retail and that it accelerated the transition to online and made e-commerce a top priority for every brand that strives to survive in the new digital reality,” said Pasha Bogdanov, General Partner, Almaz Capital. “3DLOOK not only offers an innovative solution that helps online retailers reduce returns and ensure higher client satisfaction, but also enables a unique personalized shopping experience. We’re excited to help 3DLOOK as it expands and meets the growing demand for its solutions.”

As consumers have shifted much of their spending toward e-commerce, 3DLOOK has seen significant recent growth, with revenue increasing by 5.6 times since April 2020. 3DLOOK counts more than 100 customers worldwide, including a uniform industry giant Fechheimer Brothers (a Berkshire Hathaway company) and Safariland, a leader in body armor. Previous investors in 3DLOOK include Boost VC, 500 Startups, ICU Ventures, U Ventures (part of Horizon Capital) and supermodel Natalia Vodianova.

“The headache of modern online sales is the return of a large percentage of unsuitable goods to the seller. 3DLOOK successfully solves this problem and by this significantly increases the marginality of the business. The new round of funding will help the team confidently move forward with its product and conquer the market” – Artyom Inyutin, Co-founder & Head of Investments, TMT Investments

About 3DLOOK

3DLOOK is the global leader in AI-first mobile body measuring and fit solutions. The company’s solutions enable innovative personalized shopping experiences based on a consumer’s unique body measurement and shape data and give brands actionable insights to optimize design, product development, inventory planning and distribution. The company was the 2019 winner of the LVMH Innovation Award and the IEEE Retail Digital Transformation Grand Challenge and was recognized as one of the 2020 Pioneers of the New World.

About Almaz Capital

Almaz Capital is a global VC fund headquartered in Silicon Valley with the offices in CEE countries. Almaz Capital focuses on disruptive deep-tech companies in the B2B software space, including AI/ML and blockchain applications, IoT and edge computing enablers, and cybersecurity. The fund’s investors include Cisco, EIF, EBRD and IFC.

Founded in 2008, Almaz Capital has 15 exits and over 25 portfolio companies. Among the most famous deals of Almaz Capital are Yandex (IPO NASDAQ), QIK (sold to Skype), Sensity Systems (sold to Verizon Communications) and Acumatica (sold to EQT).

About Zubr Capital

Zubr Capital is a private equity fund management company. Zubr Capital is focused on investing in classifieds, e-commerce, Cloud & SaaS, fintech, AdTech, EduTech, IT-service. Zubr Capital manages two funds: SMH and Zubr Capital Fund I (ZCFI). Among the shareholders of ZCFI are international financial institutions (EBRD, FMO), private companies (Wargaming) and individuals from the CIS countries. Key markets: Belarus, Ukraine, Lithuania, Poland.

About TMT Investments

TMT Investments Plc is a venture capital company that invests in fast-growing technology enterprises at an early stage with global scale ambitions. TMT has invested into 72 companies since it was listed in AIM in December 2010, where it became one of the first publicly traded venture capital instruments in the UK, providing investors with access to high-yielding international private technology companies. The Company focuses on identifying investment opportunities in the segments, such as e-commerce, marketplaces, cloud, Big Data and SaaS.

Media Contact:

Nadya Movchan

PR Manager, 3DLOOK

nadya.movchan@3dlook.me